getwd()해당 자료는 전북대학교 이영미 교수님 2023고급시계열분석 자료임

setwd("/home/coco/Dropbox/Scribbling/posts")import

############## package

library(forecast) #ses

library(data.table)

library(ggplot2)

library(lmtest) #dwtest

library(TTR) #SMA

library(lubridate)

library(gridExtra)Registered S3 method overwritten by 'quantmod':

method from

as.zoo.data.frame zoo

Loading required package: zoo

Attaching package: ‘zoo’

The following objects are masked from ‘package:base’:

as.Date, as.Date.numeric

Attaching package: ‘lubridate’

The following objects are masked from ‘package:data.table’:

hour, isoweek, mday, minute, month, quarter, second, wday, week,

yday, year

The following objects are masked from ‘package:base’:

date, intersect, setdiff, union

CH03

1

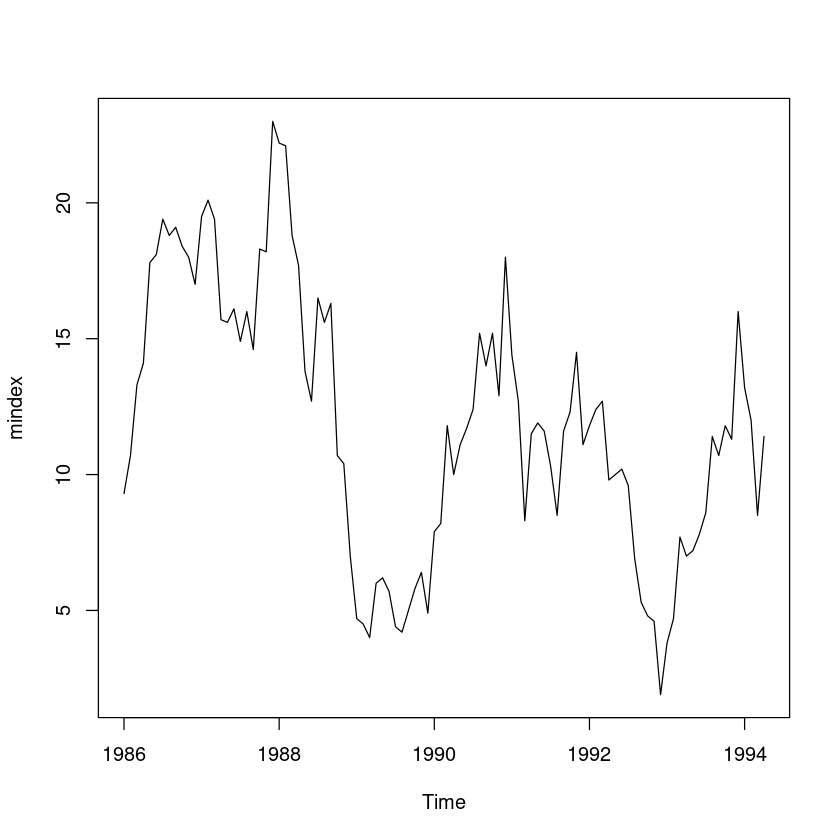

중간재출하지수 자료를 이용하여, 초기 평활값 \(S_0^{(1)} = 15\)를 사용하여 \(ω = 0.6\)와 \(ω = 0.2\)의 각 경우에 1-시차 후 예측값 \(Z_{t−1}^{(1)}, t = 2, 3, 99, 100\)을 계산하여라.

z <- scan("mindex.txt")

mindex <- ts(z, start = c(1986, 1), frequency = 12)

mindex| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1986 | 9.3 | 10.7 | 13.3 | 14.1 | 17.8 | 18.1 | 19.4 | 18.8 | 19.1 | 18.4 | 18.0 | 17.0 |

| 1987 | 19.5 | 20.1 | 19.4 | 15.7 | 15.6 | 16.1 | 14.9 | 16.0 | 14.6 | 18.3 | 18.2 | 23.0 |

| 1988 | 22.2 | 22.1 | 18.8 | 17.7 | 13.8 | 12.7 | 16.5 | 15.6 | 16.3 | 10.7 | 10.4 | 7.0 |

| 1989 | 4.7 | 4.5 | 4.0 | 6.0 | 6.2 | 5.7 | 4.4 | 4.2 | 5.0 | 5.8 | 6.4 | 4.9 |

| 1990 | 7.9 | 8.2 | 11.8 | 10.0 | 11.1 | 11.7 | 12.4 | 15.2 | 14.0 | 15.2 | 12.9 | 18.0 |

| 1991 | 14.4 | 12.7 | 8.3 | 11.5 | 11.9 | 11.6 | 10.3 | 8.5 | 11.6 | 12.3 | 14.5 | 11.1 |

| 1992 | 11.8 | 12.4 | 12.7 | 9.8 | 10.0 | 10.2 | 9.6 | 6.9 | 5.3 | 4.8 | 4.6 | 1.9 |

| 1993 | 3.8 | 4.7 | 7.7 | 7.0 | 7.2 | 7.8 | 8.6 | 11.4 | 10.7 | 11.8 | 11.3 | 16.0 |

| 1994 | 13.2 | 12.0 | 8.5 | 11.4 |

plot(mindex)

- 추세도 없고 계절성분도 없으니 단순지수평활을 한다.

모형 단순지수평활법 사용 \(Z_t = \beta_{0,t} + \epsilon_t\)

예측 \(\hat Z_n(l) = w Z_n + (1-w) \hat Z_{n-1}(l)\)

-

초기 예측값 \(Z_1^{(1)}\)은 초기 평활값 \(S_0^{(1)}\)를 사용하여 계산

\(Z_1^{(1)} = S_0^{(1)}=15\)

- w= 0.2

fit0 <- HoltWinters(mindex,

alpha = 0.2,

beta = FALSE,

gamma = FALSE,

l.start = 15)fit0Holt-Winters exponential smoothing without trend and without seasonal component.

Call:

HoltWinters(x = mindex, alpha = 0.2, beta = FALSE, gamma = FALSE, l.start = 15.1875)

Smoothing parameters:

alpha: 0.2

beta : FALSE

gamma: FALSE

Coefficients:

[,1]

a 10.97935head(cbind(fit0$fitted, mindex))| fit0$fitted.xhat | fit0$fitted.level | mindex | |

|---|---|---|---|

| Jan 1986 | NA | NA | 9.3 |

| Feb 1986 | 15.00000 | 15.00000 | 10.7 |

| Mar 1986 | 14.14000 | 14.14000 | 13.3 |

| Apr 1986 | 13.97200 | 13.97200 | 14.1 |

| May 1986 | 13.99760 | 13.99760 | 17.8 |

| Jun 1986 | 14.75808 | 14.75808 | 18.1 |

- t=2

\(S_2^{(1)} = wZ_2 + (1-w)S_0^{(1)}\)

0.2 * 10.7 + 0.8 * 15\(S_3^{(1)} = w Z_3 + w (1-w) Z_2 + (1-w)^2 S_0^{(1)}\)

0.2 * 13.3 + 0.2 * 0.8 * 10.7 + 0.8 * 0.8 * 15tail(cbind(fit0$fitted, mindex))| fit0$fitted.xhat | fit0$fitted.level | mindex | |

|---|---|---|---|

| Nov 1993 | 9.156768 | 9.156768 | 11.3 |

| Dec 1993 | 9.585414 | 9.585414 | 16.0 |

| Jan 1994 | 10.868331 | 10.868331 | 13.2 |

| Feb 1994 | 11.334665 | 11.334665 | 12.0 |

| Mar 1994 | 11.467732 | 11.467732 | 8.5 |

| Apr 1994 | 10.874186 | 10.874186 | 11.4 |

\(S_{99}^{(1)} = w Z_{99} + w (1-w) Z_{98} + \dots + (1-w)^{100} S_0^{(1)}\)

- 예측 갱신

\[S_n^{(1)} = wZ_n + (1-w)S_{n-1}^{(1)}\]

\(S_{100}^{(1)} = w Z_{100} + (1-w) S_{(99)}^{(1)}\)

0.2 * 11.4 + 0.8 * 10.874186\(S_{99}^{(1)} = w Z_{99} + (1-w) S_{(98)}^{(1)}\)

0.2 * 8.5 + 0.8 * 11.467732- w = 0.6

fit1 <- HoltWinters(mindex,

alpha = 0.6,

beta = FALSE,

gamma = FALSE,

l.start = 15)fit1Holt-Winters exponential smoothing without trend and without seasonal component.

Call:

HoltWinters(x = mindex, alpha = 0.6, beta = FALSE, gamma = FALSE, l.start = 15)

Smoothing parameters:

alpha: 0.6

beta : FALSE

gamma: FALSE

Coefficients:

[,1]

a 10.90021head(cbind(fit1$fitted, mindex))| fit1$fitted.xhat | fit1$fitted.level | mindex | |

|---|---|---|---|

| Jan 1986 | NA | NA | 9.3 |

| Feb 1986 | 15.00000 | 15.00000 | 10.7 |

| Mar 1986 | 12.42000 | 12.42000 | 13.3 |

| Apr 1986 | 12.94800 | 12.94800 | 14.1 |

| May 1986 | 13.63920 | 13.63920 | 17.8 |

| Jun 1986 | 16.13568 | 16.13568 | 18.1 |

- t=2

\(S_2^{(1)} = wZ_2 + (1-w)S_0^{(1)}\)

0.6 * 10.7 + 0.4 * 15\(S_3^{(1)} = w Z_3 + w (1-w) Z_2 + (1-w)^2 S_0^{(1)}\)

0.6 * 13.3 + 0.6*0.4*10.7 + 0.4*0.4*15tail(cbind(fit1$fitted, mindex))| fit1$fitted.xhat | fit1$fitted.level | mindex | |

|---|---|---|---|

| Nov 1993 | 11.26423 | 11.26423 | 11.3 |

| Dec 1993 | 11.28569 | 11.28569 | 16.0 |

| Jan 1994 | 14.11428 | 14.11428 | 13.2 |

| Feb 1994 | 13.56571 | 13.56571 | 12.0 |

| Mar 1994 | 12.62628 | 12.62628 | 8.5 |

| Apr 1994 | 10.15051 | 10.15051 | 11.4 |

\(S_{99}^{(1)} = w Z_{99} + w (1-w) Z_{98} + \dots + (1-w)^{100} S_0^{(1)}\)

- 예측 갱신

\[S_n^{(1)} = wZ_n + (1-w)S_{n-1}^{(1)}\]

\(S_{100}^{(1)} = w Z_{100} + (1-w) S_{(99)}^{(1)}\)

0.6*11.4+0.4*10.15051\(S_{99}^{(1)} = w Z_{99} + (1-w) S_{(98)}^{(1)}\)

0.6*8.5+0.4*12.626282 (예측오차분석을 안했다.;;)

(R 실습) 다음의 각 자료에 대해 적절한 평활법을 적용한 후 , 예측오차 분석을 하여 적용한 평활법이 적절했는지 논하여라. 그리고 (2)번의 경우 첫번째 과제 5,6번에서 적합한 모형과 1-시차 후 예측 오차의 제곱합 (SSE) 기준하에서 예측력을 비교하여라.

(1)

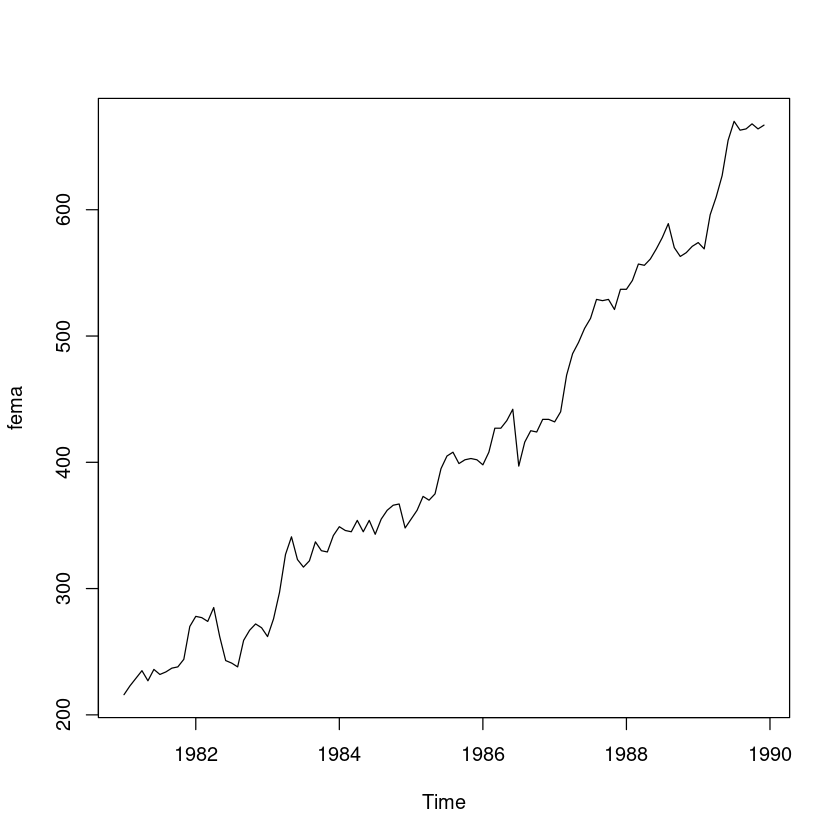

‘female.txt’ : 월별 전문기술행정직에 종사하는 여성근로자 수 (단위:명)

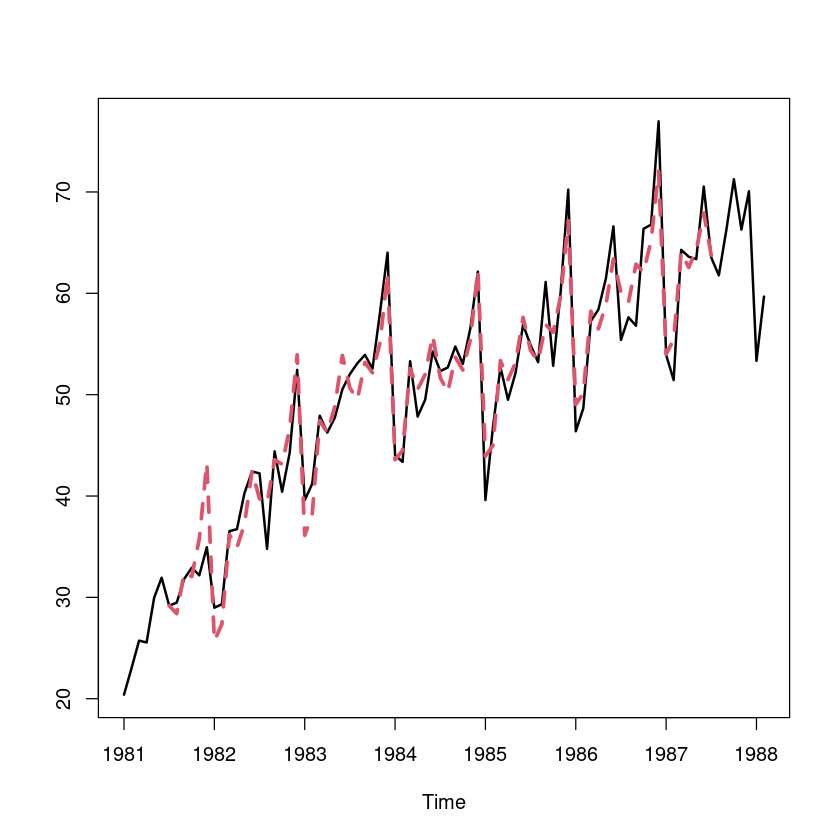

female <- scan("female.txt")fema <- ts(female, start=c(1981,1), frequency=12)plot(fema)

- 시도표를 확인해보니 추세성분과 불규칙성분으로 이루어져 있다. —> 이중지수평활을 사용한다.

- 1모수 이중지수 평활

w <- c(seq(0.1, 0.8, 0.1), seq(0.81, 0.99, 0.01))df <- data.frame(alpha = numeric(length(w)), beta = numeric(length(w)), sse = numeric(length(w)))

for (i in 1:length(w)) {

alpha <- w[i]

beta <- w[i]

fit <- HoltWinters(fema, alpha = alpha, beta = beta, gamma = FALSE)

sse <- fit$SSE

df[i, ] <- c(alpha, beta, sse)

}df| alpha | beta | sse |

|---|---|---|

| <dbl> | <dbl> | <dbl> |

| 0.10 | 0.10 | 47737.16 |

| 0.20 | 0.20 | 39413.25 |

| 0.30 | 0.30 | 32655.02 |

| 0.40 | 0.40 | 28136.56 |

| 0.50 | 0.50 | 23964.31 |

| 0.60 | 0.60 | 21390.42 |

| 0.70 | 0.70 | 20179.01 |

| 0.80 | 0.80 | 19991.82 |

| 0.81 | 0.81 | 20034.76 |

| 0.82 | 0.82 | 20090.85 |

| 0.83 | 0.83 | 20160.82 |

| 0.84 | 0.84 | 20245.43 |

| 0.85 | 0.85 | 20345.55 |

| 0.86 | 0.86 | 20462.10 |

| 0.87 | 0.87 | 20596.12 |

| 0.88 | 0.88 | 20748.74 |

| 0.89 | 0.89 | 20921.19 |

| 0.90 | 0.90 | 21114.85 |

| 0.91 | 0.91 | 21331.22 |

| 0.92 | 0.92 | 21571.99 |

| 0.93 | 0.93 | 21839.02 |

| 0.94 | 0.94 | 22134.40 |

| 0.95 | 0.95 | 22460.49 |

| 0.96 | 0.96 | 22819.94 |

| 0.97 | 0.97 | 23215.75 |

| 0.98 | 0.98 | 23651.34 |

| 0.99 | 0.99 | 24130.60 |

1모수 이중지수일때는 \(\alpha=\beta=0.8\)일 때, SSE값이 19991.82 값을 가진다.

- 이중지수평활 추정

fit_fema <- HoltWinters(fema, gamma=FALSE)fit_femaHolt-Winters exponential smoothing with trend and without seasonal component.

Call:

HoltWinters(x = fema, gamma = FALSE)

Smoothing parameters:

alpha: 1

beta : 0.01666631

gamma: FALSE

Coefficients:

[,1]

a 667.000000

b 5.145043predict(fit_fema, n.ahead=12, prediction.interval = T, level=0.95) | fit | upr | lwr | |

|---|---|---|---|

| Jan 1990 | 672.1450 | 694.8066 | 649.4835 |

| Feb 1990 | 677.2901 | 709.6065 | 644.9736 |

| Mar 1990 | 682.4351 | 722.3438 | 642.5264 |

| Apr 1990 | 687.5802 | 734.0440 | 641.1163 |

| May 1990 | 692.7252 | 745.1007 | 640.3498 |

| Jun 1990 | 697.8703 | 755.7139 | 640.0266 |

| Jul 1990 | 703.0153 | 766.0016 | 640.0290 |

| Aug 1990 | 708.1603 | 776.0399 | 640.2807 |

| Sep 1990 | 713.3054 | 785.8813 | 640.7295 |

| Oct 1990 | 718.4504 | 795.5635 | 641.3374 |

| Nov 1990 | 723.5955 | 805.1148 | 642.0761 |

| Dec 1990 | 728.7405 | 814.5572 | 642.9238 |

fit_fema$SSE- 단순지수평활법 적합

fit_fema2 <- HoltWinters(fema, beta=FALSE, gamma=FALSE)

fit_fema2

fit_fema2$SSEHolt-Winters exponential smoothing without trend and without seasonal component.

Call:

HoltWinters(x = fema, beta = FALSE, gamma = FALSE)

Smoothing parameters:

alpha: 0.9999225

beta : FALSE

gamma: FALSE

Coefficients:

[,1]

a 666.9998- 계절지수평활법 적합

fit_fema3 <- HoltWinters(fema, seasonal="additive")

fit_fema3

fit_fema3$SSEHolt-Winters exponential smoothing with trend and additive seasonal component.

Call:

HoltWinters(x = fema, seasonal = "additive")

Smoothing parameters:

alpha: 0.5689925

beta : 0.01533418

gamma: 1

Coefficients:

[,1]

a 677.319852

b 4.462732

s1 -10.805353

s2 -10.907550

s3 13.687188

s4 21.650246

s5 29.187883

s6 39.477663

s7 33.205948

s8 19.062994

s9 5.235871

s10 -3.290505

s11 -11.437139

s12 -10.319852(2)

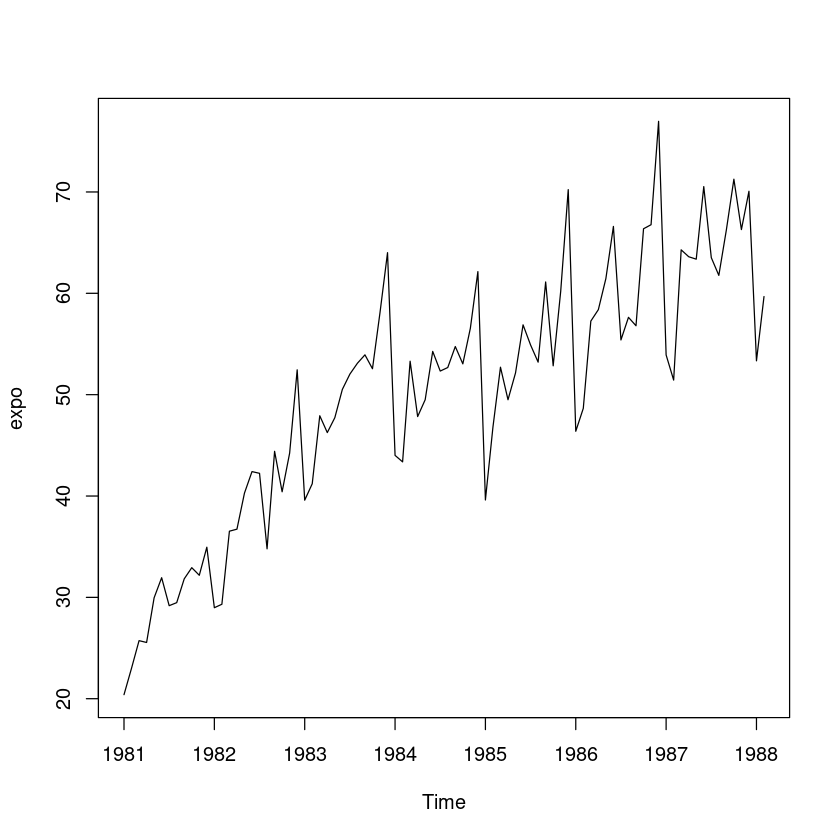

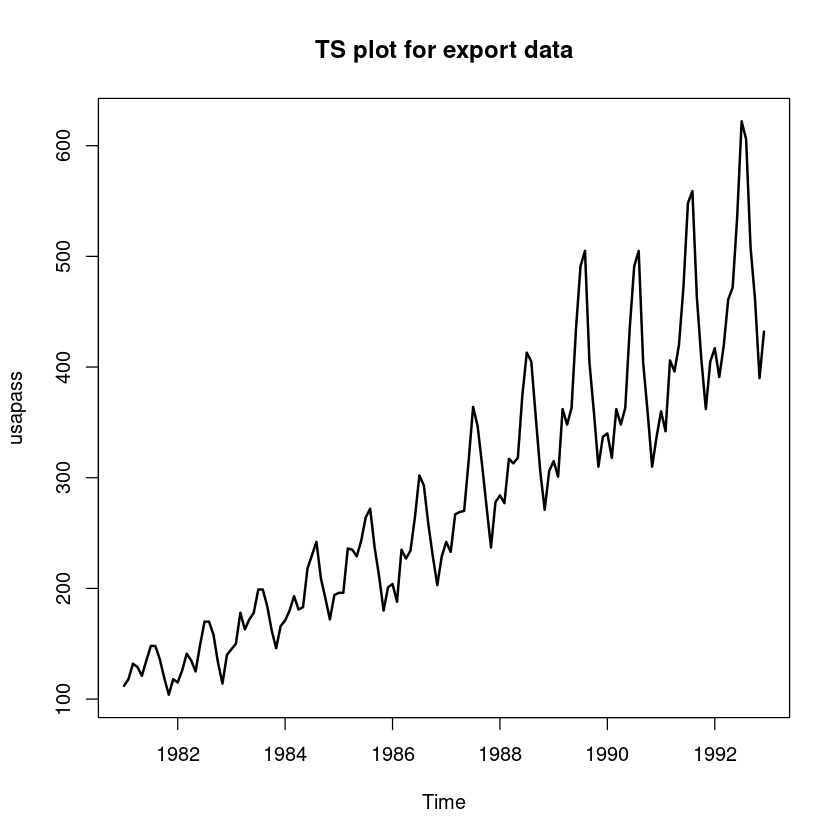

‘export.txt’ ; 월별수출액(단위:억$)

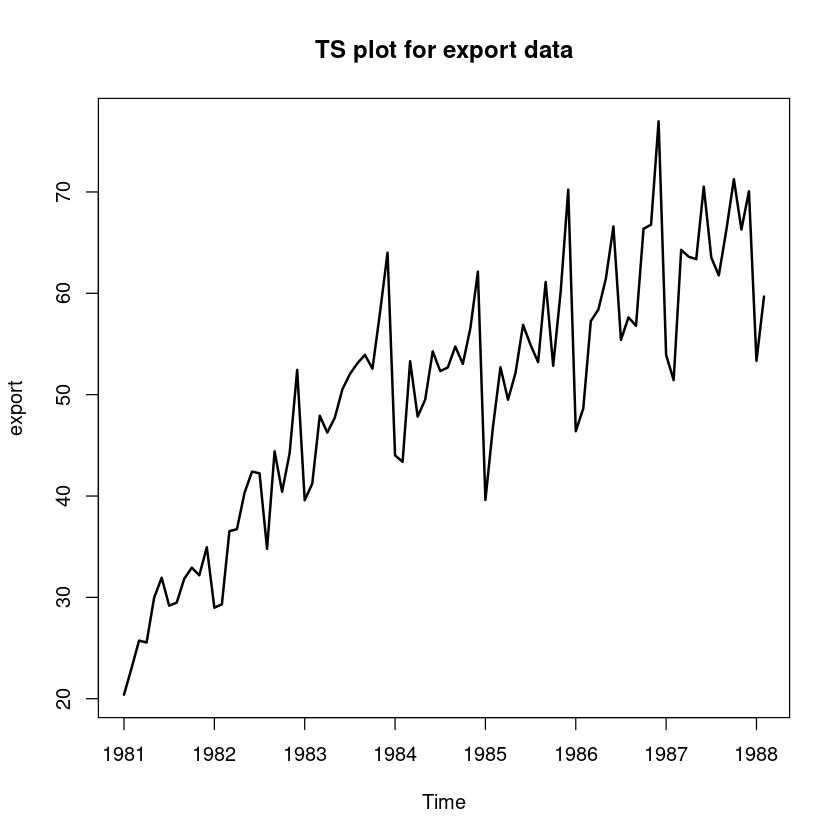

export <- scan("export.txt")expo <- ts(export, start=c(1981,1), frequency=12)plot.ts(expo)

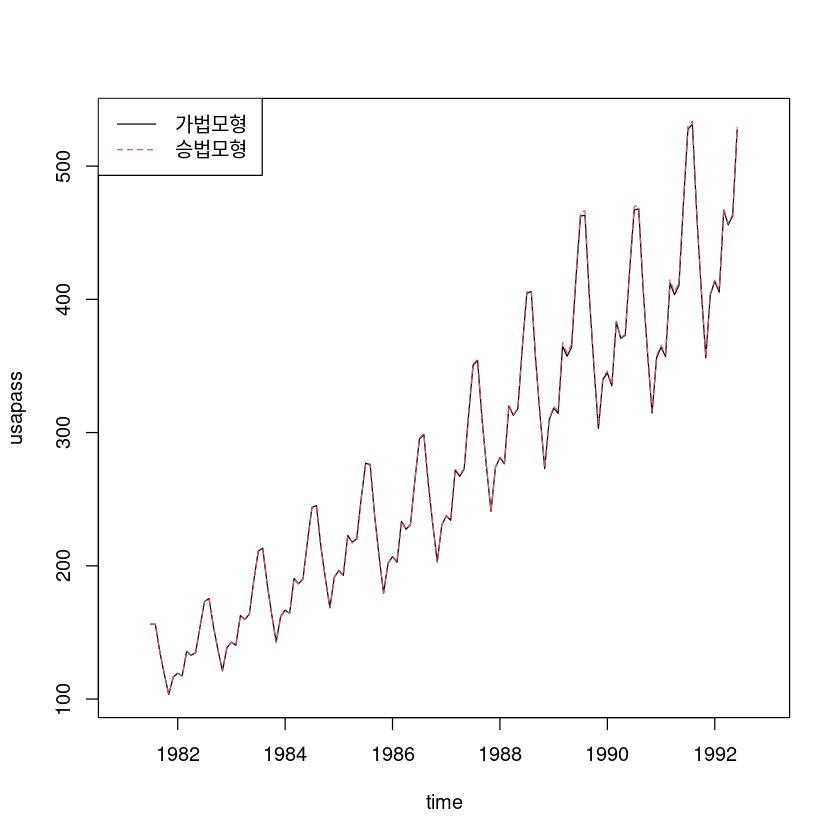

- 추세성분, 계절성분(주기12), 불규칙성분으로 구성되어 있다. –> 계절지수 평활을 이용하자!

- 가법모형

fit_expo_a <- HoltWinters(expo, seasonal="additive") #default는 additive

fit_expo_aHolt-Winters exponential smoothing with trend and additive seasonal component.

Call:

HoltWinters(x = expo, seasonal = "additive")

Smoothing parameters:

alpha: 0.3304767

beta : 0.04369053

gamma: 0.6102758

Coefficients:

[,1]

a 66.9300146

b 0.3670945

s1 -0.9590061

s2 -2.3460160

s3 -1.4388022

s4 4.0020957

s5 -2.8546787

s6 -3.1036803

s7 0.4486017

s8 3.3118493

s9 1.6302355

s10 8.0731659

s11 -11.5480012

s12 -8.8892298fit_expo_m <- HoltWinters(expo, seasonal="multiplicative")

fit_expo_mHolt-Winters exponential smoothing with trend and multiplicative seasonal component.

Call:

HoltWinters(x = expo, seasonal = "multiplicative")

Smoothing parameters:

alpha: 0.4285887

beta : 0.02606259

gamma: 0.4083356

Coefficients:

[,1]

a 68.7136998

b 0.5141142

s1 0.9879869

s2 0.9620299

s3 0.9996946

s4 1.0834386

s5 0.9897148

s6 0.9744549

s7 1.0319339

s8 1.0425559

s9 1.0357445

s10 1.1286956

s11 0.8073858

s12 0.8400441fit_expo_a$SSEfit_expo_m$SSE승법 모형의 SSE가 더 작으니 이 모형을 선택하자.

- 이중지수

fit_expo2<- HoltWinters(expo, gamma=FALSE )

fit_expo2$SSEfit_expo3<- HoltWinters(expo, beta=FALSE, gamma=FALSE )

fit_expo3$SSEhw1_6

z <- scan("export.txt")

n <- length(z)

nz_ts <- ts(z, frequency=12)

cycle(z_ts)| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 2 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 3 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 4 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 5 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 6 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 7 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 8 | 1 | 2 |

seasonal_I <- as.factor(cycle(z_ts))

t <- 1:n

m2 <- lm(z~t+seasonal_I)summary(m2)

Call:

lm(formula = z ~ t + seasonal_I)

Residuals:

Min 1Q Median 3Q Max

-10.8562 -2.2938 0.1567 2.6730 9.3951

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 21.98000 1.73500 12.669 < 2e-16 ***

t 0.43721 0.01893 23.097 < 2e-16 ***

seasonal_I2 1.71779 2.16697 0.793 0.430512

seasonal_I3 9.21741 2.24422 4.107 0.000103 ***

seasonal_I4 7.37163 2.24366 3.286 0.001566 **

seasonal_I5 9.30299 2.24326 4.147 8.98e-05 ***

seasonal_I6 12.96578 2.24302 5.780 1.72e-07 ***

seasonal_I7 9.16286 2.24294 4.085 0.000112 ***

seasonal_I8 7.73422 2.24302 3.448 0.000941 ***

seasonal_I9 11.07272 2.24326 4.936 4.88e-06 ***

seasonal_I10 10.68409 2.24366 4.762 9.47e-06 ***

seasonal_I11 12.37545 2.24422 5.514 5.03e-07 ***

seasonal_I12 18.57967 2.24494 8.276 4.26e-12 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 4.334 on 73 degrees of freedom

Multiple R-squared: 0.9011, Adjusted R-squared: 0.8848

F-statistic: 55.4 on 12 and 73 DF, p-value: < 2.2e-16SSE <- sum(m2$residuals^2)

SSE과제 1에서 적합한 선형모델보다 평활법(계절지수, 가법_승법_)으로 적합한 모델의 SSE가 너 낮게 나왔다.

3

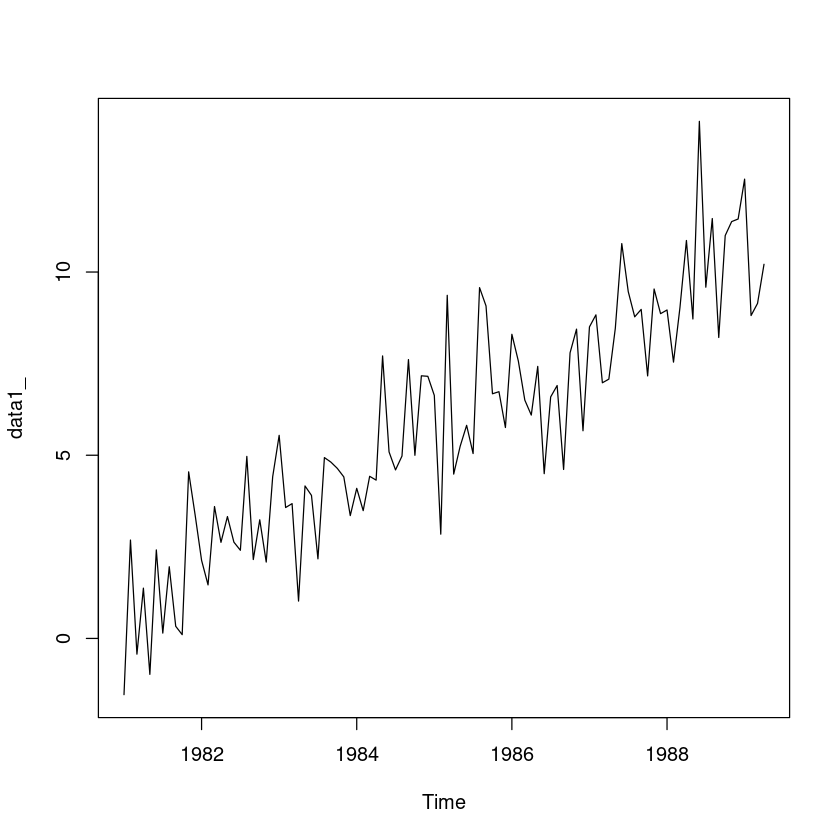

(R 실습) ’data1.csv’는 모의 실험에 의해 생성된 시계열자료(t:시간, z:시계열자료)이다.다음 물음 에 답하여라.

data1 <- read.csv("data1.csv")

t <- data1$t

y <- data1$z

z <- cbind(x,y)

n <- length(data1$t)

data1_ <- ts(y, start=c(1981,1),frequency=12)

data1_| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1981 | -1.5346871 | 2.6850469 | -0.4288189 | 1.3724199 | -0.9800884 | 2.4156505 | 0.1460579 | 1.9565546 | 0.3314012 | 0.1031952 | 4.5465702 | 3.3733991 |

| 1982 | 2.1320092 | 1.4610979 | 3.5995999 | 2.6229617 | 3.3260846 | 2.6279068 | 2.4061911 | 4.9681833 | 2.1537724 | 3.2376604 | 2.0848844 | 4.4146009 |

| 1983 | 5.5427871 | 3.5727733 | 3.6793795 | 1.0197987 | 4.1619256 | 3.9038326 | 2.1724542 | 4.9360919 | 4.8127781 | 4.6404884 | 4.4090738 | 3.3529045 |

| 1984 | 4.0967541 | 3.4881527 | 4.4249974 | 4.3210561 | 7.7103219 | 5.0907609 | 4.5999605 | 4.9773808 | 7.6107690 | 4.9986647 | 7.1678722 | 7.1542270 |

| 1985 | 6.6329637 | 2.8462231 | 9.3646617 | 4.4855729 | 5.2444451 | 5.8160173 | 5.0466196 | 9.5742821 | 9.0751720 | 6.6775546 | 6.7345322 | 5.7569890 |

| 1986 | 8.3008035 | 7.5701959 | 6.5050066 | 6.0962461 | 7.4245090 | 4.4973441 | 6.5920516 | 6.9026479 | 4.6123368 | 7.7952478 | 8.4416974 | 5.6684225 |

| 1987 | 8.5028659 | 8.8312543 | 6.9776594 | 7.0775957 | 8.4638087 | 10.7761422 | 9.4661818 | 8.7774843 | 8.9804188 | 7.1654550 | 9.5367387 | 8.8641697 |

| 1988 | 8.9645710 | 7.5418683 | 9.0336999 | 10.8611356 | 8.7190544 | 14.1133979 | 9.5868440 | 11.4598053 | 8.2142746 | 10.9960972 | 11.3776375 | 11.4480245 |

| 1989 | 12.5356509 | 8.8132146 | 9.1437447 | 10.2114895 |

plot(data1_)

- 추세와 계절성분, 불규칙성이 있어보인다.

(1) 교수님은 계절성분이 없고 추세만 있어 모형을 적합하였음

적절한 추세 모형을 적합시킨 후 잔차분석을 하여라.

계절추세모형 \[Z_t = \beta_0 + \beta_1 + \sum_{i=1}^l 2\delta_i \times I_{tl} + \epsilon_t$, 단 $\delta_1=0\]

cycle(data1_)| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1981 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 1982 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 1983 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 1984 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 1985 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 1986 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 1987 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 1988 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 1989 | 1 | 2 | 3 | 4 |

seasonal_I <- as.factor(cycle(data1_))

#t <- 1:n

m2 <- lm(y~ 0+ t +seasonal_I)summary(m2)

Call:

lm(formula = y ~ 0 + t + seasonal_I)

Residuals:

Min 1Q Median 3Q Max

-3.4526 -0.8739 -0.1227 0.8747 3.7703

Coefficients:

Estimate Std. Error t value Pr(>|t|)

t 0.09971 0.00507 19.667 < 2e-16 ***

seasonal_I1 1.24446 0.54646 2.277 0.02522 *

seasonal_I2 0.21542 0.54878 0.393 0.69562

seasonal_I3 0.72572 0.55115 1.317 0.19138

seasonal_I4 0.15582 0.55354 0.282 0.77899

seasonal_I5 0.82223 0.56859 1.446 0.15175

seasonal_I6 1.36889 0.57074 2.398 0.01860 *

seasonal_I7 0.11609 0.57292 0.203 0.83990

seasonal_I8 1.70838 0.57513 2.970 0.00384 **

seasonal_I9 0.63848 0.57739 1.106 0.27185

seasonal_I10 0.51670 0.57967 0.891 0.37519

seasonal_I11 1.50257 0.58200 2.582 0.01150 *

seasonal_I12 0.86957 0.58436 1.488 0.14035

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 1.46 on 87 degrees of freedom

Multiple R-squared: 0.9584, Adjusted R-squared: 0.9522

F-statistic: 154.2 on 13 and 87 DF, p-value: < 2.2e-16- 적합모형

\(\hat Z_t = 0.09971 t +1.24446 I_{t1} \dots +0.86957 I_{t12}\)

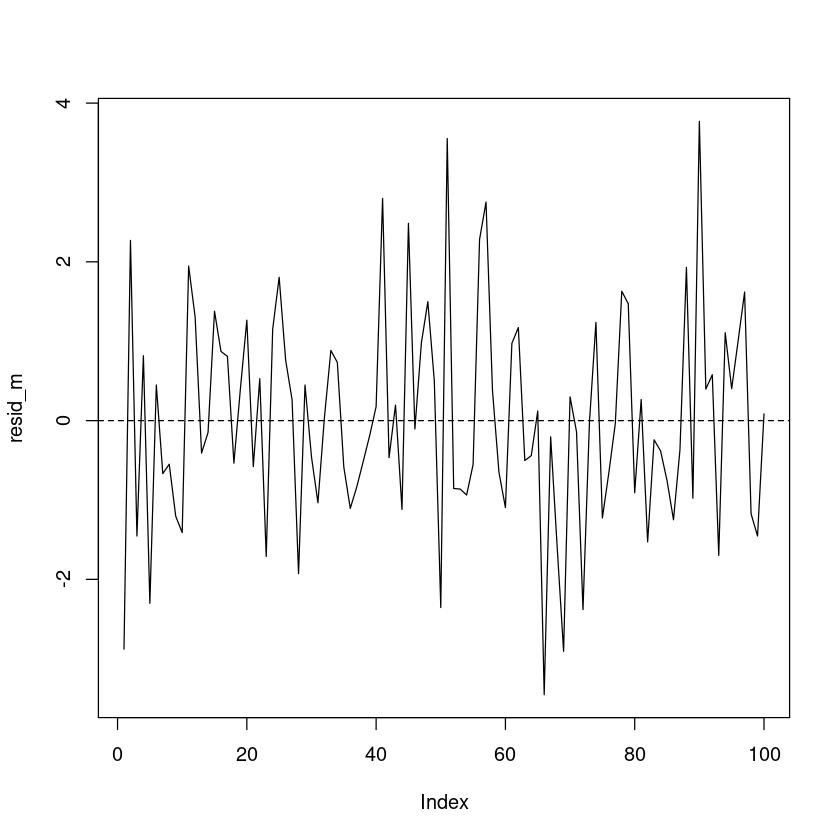

- 잔차검정

resid_m <- resid(m2)

plot(resid_m, pch=16, type='l')

abline(h=0, lty=2)

t.test(resid_m)

One Sample t-test

data: resid_m

t = 4.1891e-18, df = 99, p-value = 1

alternative hypothesis: true mean is not equal to 0

95 percent confidence interval:

-0.2716042 0.2716042

sample estimates:

mean of x

5.734074e-19 bptest(m2)

studentized Breusch-Pagan test

data: m2

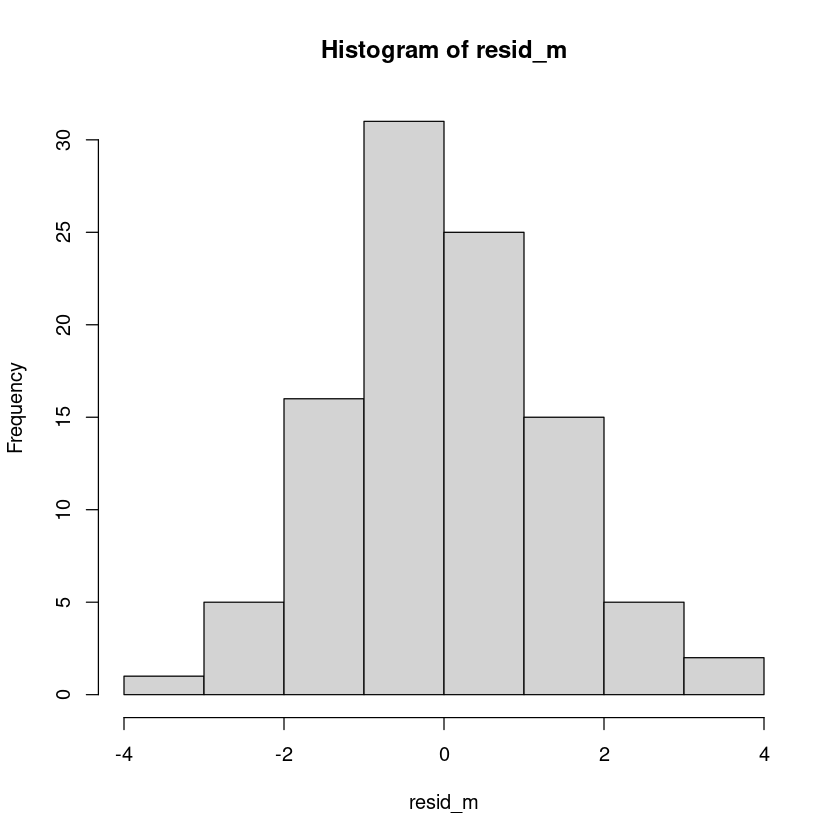

BP = 11.4, df = 12, p-value = 0.495hist(resid_m)

shapiro.test(resid_m)

Shapiro-Wilk normality test

data: resid_m

W = 0.99218, p-value = 0.8338dwtest(m2, alternative = "two.sided")

Durbin-Watson test

data: m2

DW = 2.1153, p-value = 0.5919

alternative hypothesis: true autocorrelation is not 0(2)

(1)에서 적합한 추세모형에서 1∼ 10 시차 후의 예측값을 구하여라.

new_dt <- data.frame( t = n + (1:10),

seasonal_I = as.factor(c(5:12,1,2)))

new_dt| t | seasonal_I |

|---|---|

| <int> | <fct> |

| 101 | 5 |

| 102 | 6 |

| 103 | 7 |

| 104 | 8 |

| 105 | 9 |

| 106 | 10 |

| 107 | 11 |

| 108 | 12 |

| 109 | 1 |

| 110 | 2 |

predict(m2, new_dt)- 1

- 10.8932810379944

- 2

- 11.539654967107

- 3

- 10.386568516118

- 4

- 12.0785772090589

- 5

- 11.108388789967

- 6

- 11.0863188261925

- 7

- 12.1718992420353

- 8

- 11.6386155761184

- 9

- 12.113216954006

- 10

- 11.1838957059557

a <- predict(m2, new_dt)(3)

적절한 평활법을 적용한 후 잔차분석을 하여라.

- 시도표에서 등분산으로 보이니 가법모형 적용

fit_data_a <- HoltWinters(data1_, seasonal="additive")

fit_data_aHolt-Winters exponential smoothing with trend and additive seasonal component.

Call:

HoltWinters(x = data1_, seasonal = "additive")

Smoothing parameters:

alpha: 0.1075626

beta : 0.03407311

gamma: 0.2315828

Coefficients:

[,1]

a 11.19913122

b 0.10780161

s1 -0.07016081

s2 0.66130312

s3 -0.85496062

s4 0.47657925

s5 -0.88090464

s6 -0.76891779

s7 0.57746908

s8 -0.22134249

s9 0.45302226

s10 -1.33334803

s11 -0.44879394

s12 -0.72310382ls(fit_data_a)- 'alpha'

- 'beta'

- 'call'

- 'coefficients'

- 'fitted'

- 'gamma'

- 'seasonal'

- 'SSE'

- 'x'

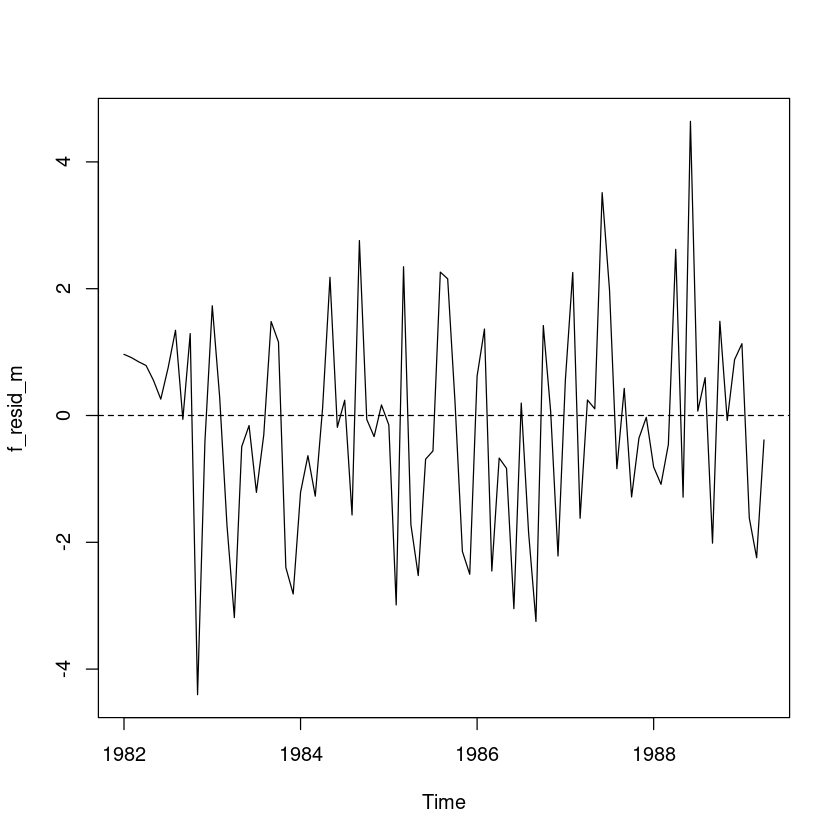

fit_data_a$SSEf_resid_m <- resid(fit_data_a)

plot(f_resid_m, pch=16, type='l')

abline(h=0, lty=2)

t.test(f_resid_m)

One Sample t-test

data: f_resid_m

t = -0.97545, df = 87, p-value = 0.332

alternative hypothesis: true mean is not equal to 0

95 percent confidence interval:

-0.5232992 0.1787545

sample estimates:

mean of x

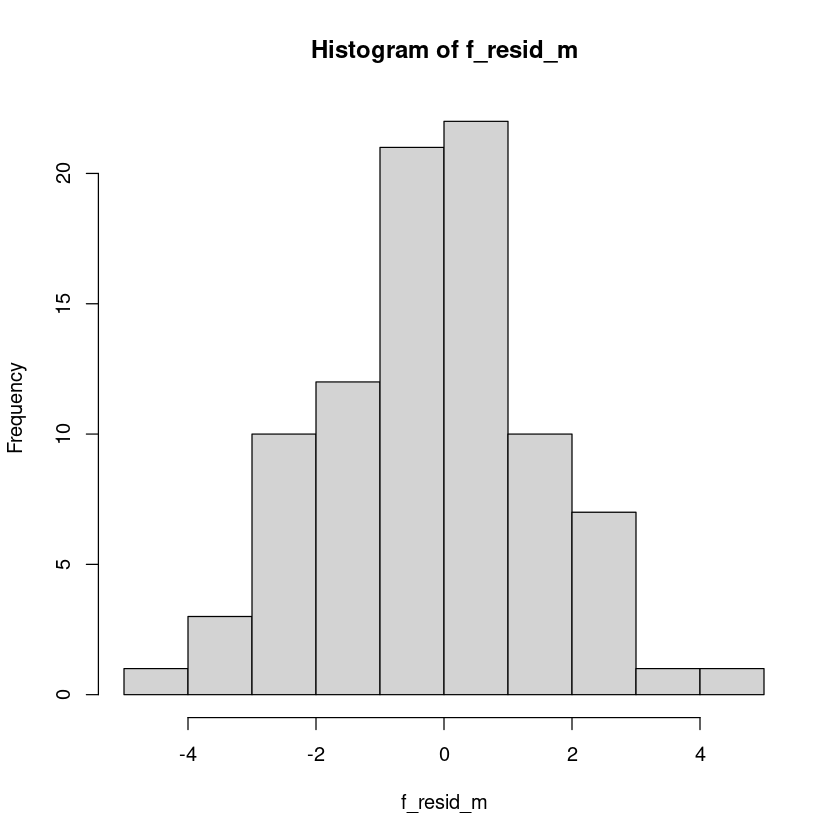

-0.1722723 hist(f_resid_m)

shapiro.test(f_resid_m)

Shapiro-Wilk normality test

data: f_resid_m

W = 0.99387, p-value = 0.9586(4)

(3)의 결과를 이용하여 1∼10시차 후의 예측값을 구하여라.

predict(fit_data_a, n.ahead=10, prediction.interval = T, level=0.95)| fit | upr | lwr | |

|---|---|---|---|

| May 1989 | 11.23677 | 14.48390 | 7.989648 |

| Jun 1989 | 12.07604 | 15.34319 | 8.808889 |

| Jul 1989 | 10.66758 | 13.95596 | 7.379195 |

| Aug 1989 | 12.10692 | 15.41775 | 8.796079 |

| Sep 1989 | 10.85723 | 14.19177 | 7.522695 |

| Oct 1989 | 11.07702 | 14.43652 | 7.717522 |

| Nov 1989 | 12.53121 | 15.91695 | 9.145475 |

| Dec 1989 | 11.84020 | 15.25346 | 8.426943 |

| Jan 1990 | 12.62237 | 16.06444 | 9.180291 |

| Feb 1990 | 10.94380 | 14.41600 | 7.471600 |

prediction_result <- predict(fit_data_a, n.ahead=10, prediction.interval = T, level=0.95)b <- prediction_result[1:10](5)

실제 1, 2, . . . , 10 시차 후의 관측값이 ’data1 new.csv’일 때, (2), (4)의 결과를 이용하여 어느 모형이 더 적합했는지에 대해 비교하여라.

data1new <- read.csv("data1_new.csv")sum((data1new$z - a)^2)sum((data1new$z - b)^2)(4)의 모형이 더 적합했다.

CH04

4

(R 실습) ’export.txt’자료에 대하여 각가 다음 물음에 답하여라.

z <- scan("export.txt")

t <- 1:length(z)

export <- ts(z, start=c(1981,1), frequency=12)

plot.ts(export, lwd=2, main="TS plot for export data")

(1)

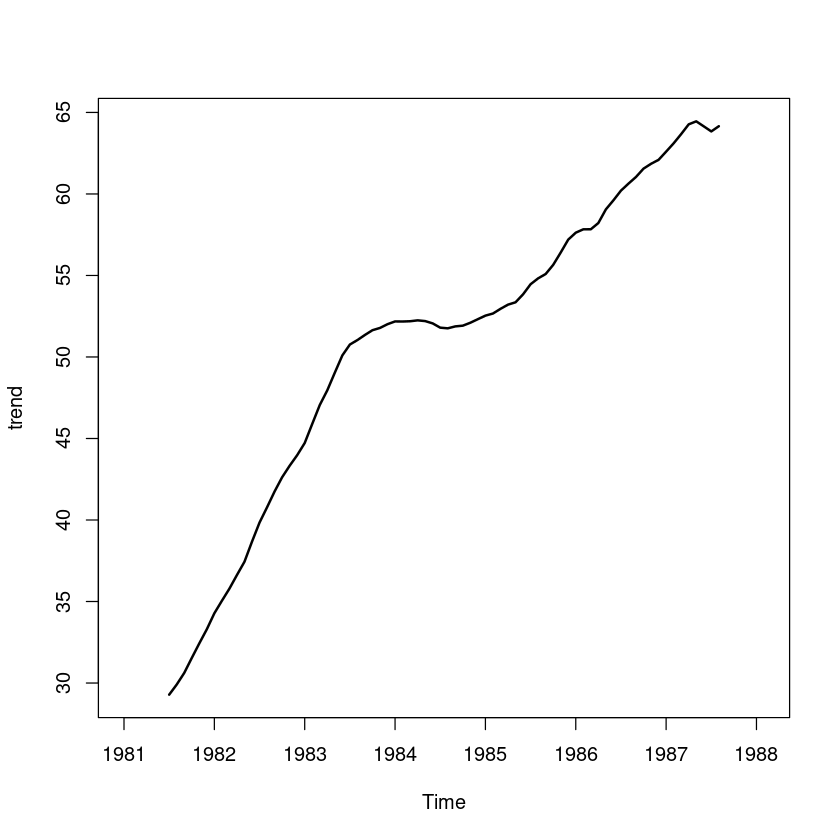

추세분석을 이용한 분해법에 의한 각 성분의 시계열 그림을 그려라.

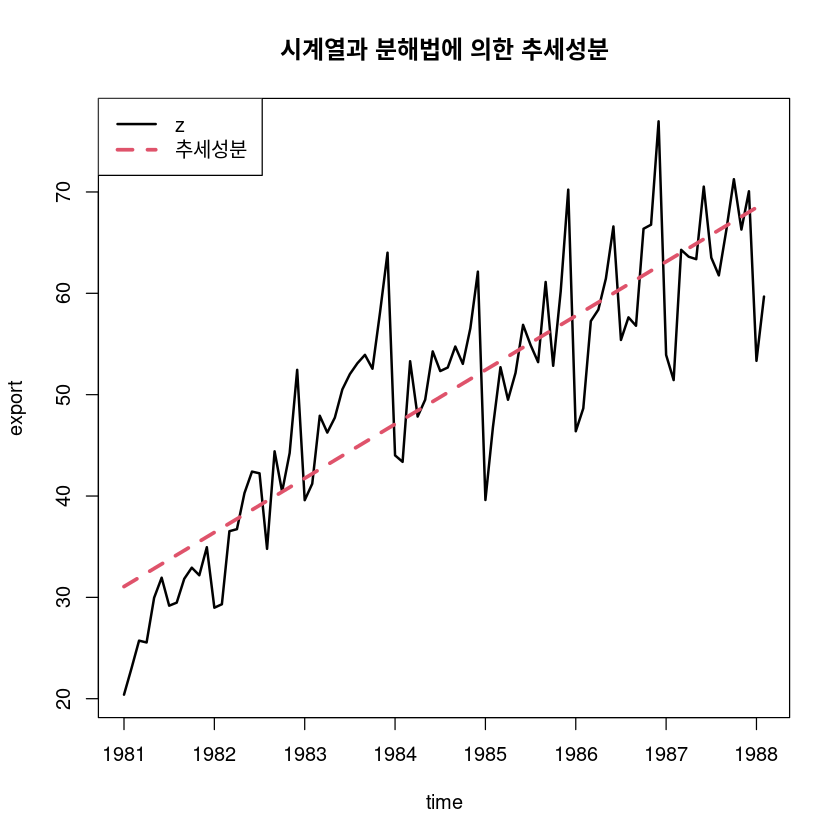

- 추세성분 추정: \(Z_t = \beta_0 + \beta_1t + \epsilon_t\) 적합

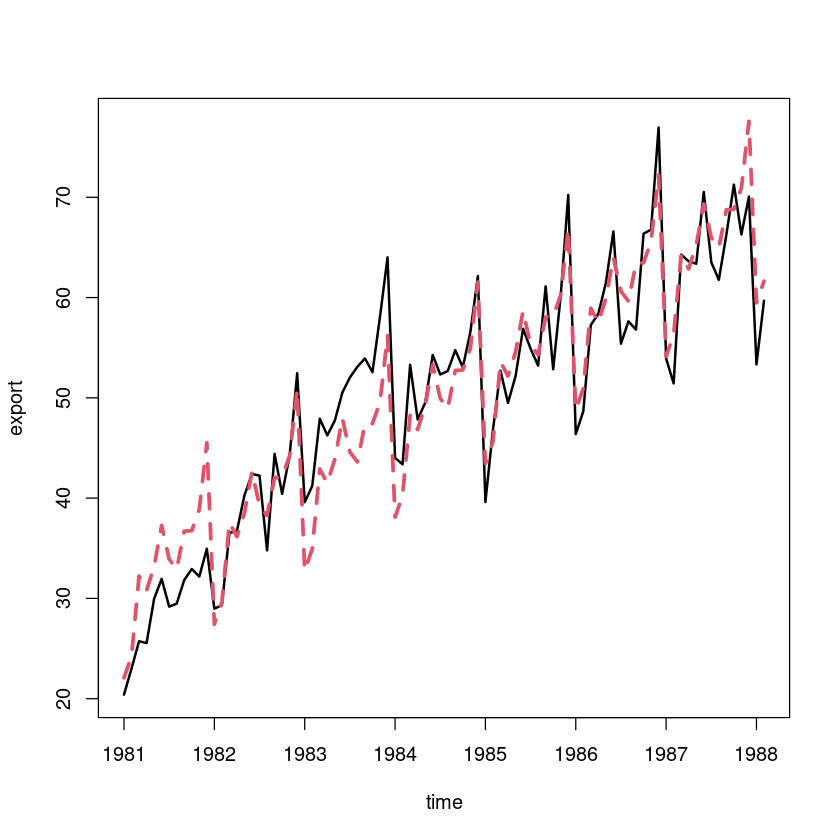

fit0 <- lm(export ~ t)

summary(fit0)

Call:

lm(formula = export ~ t)

Residuals:

Min 1Q Median 3Q Max

-15.1230 -4.0245 -0.6699 4.1819 17.3619

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 30.62075 1.37454 22.28 <2e-16 ***

t 0.44520 0.02744 16.22 <2e-16 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 6.318 on 84 degrees of freedom

Multiple R-squared: 0.758, Adjusted R-squared: 0.7552

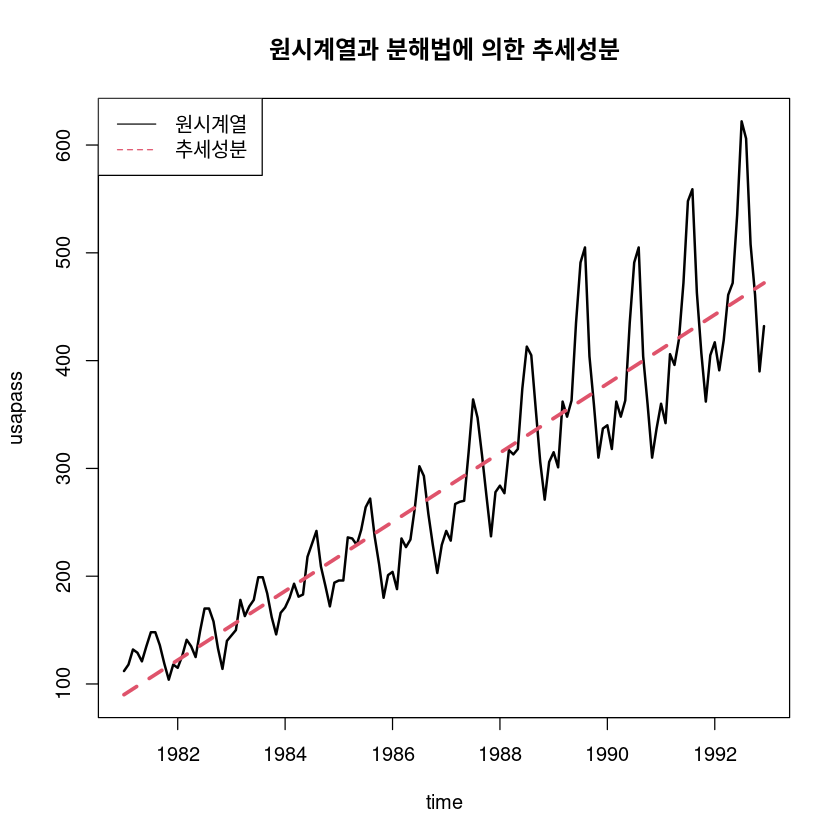

F-statistic: 263.2 on 1 and 84 DF, p-value: < 2.2e-16\(\hat T_t = 30.621 + 0.445 t\)

hat_Tt <- fitted(fit0)

ts.plot(export, hat_Tt,

col=1:2,

lty=1:2,

lwd=2:3,

ylab="export", xlab="time",

main="시계열과 분해법에 의한 추세성분")

legend("topleft", lty=1:2, col=1:2, lwd=2:3, c("z", "추세성분"))

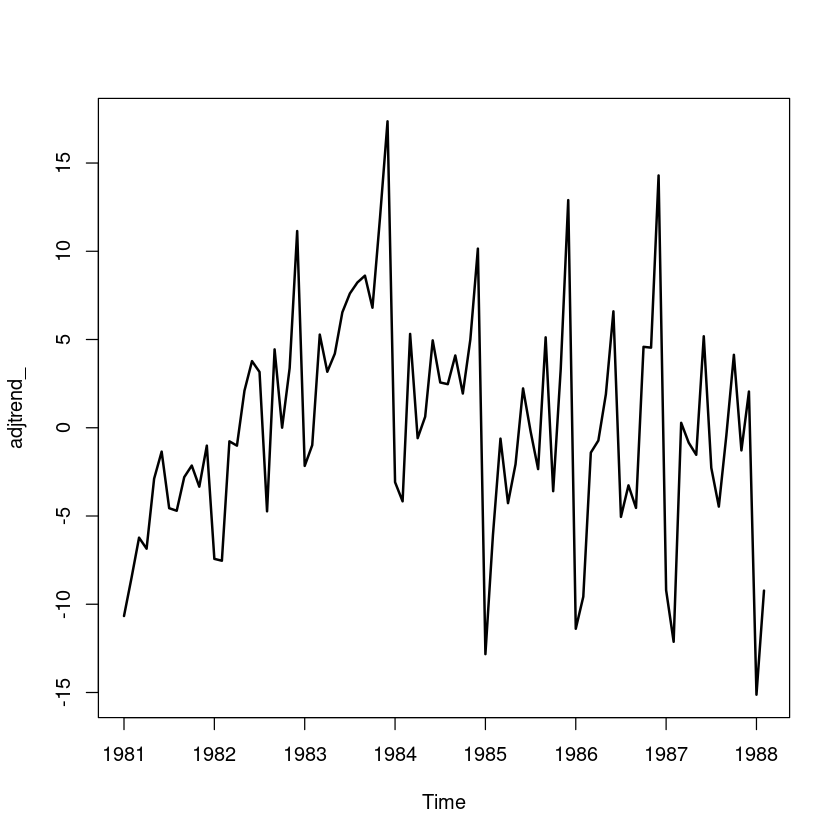

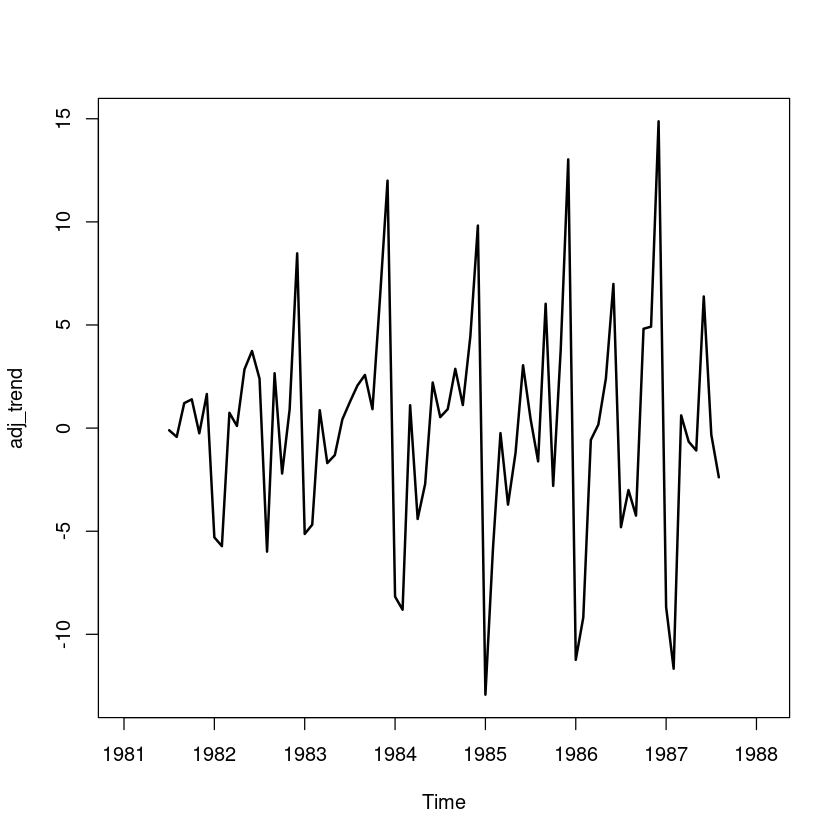

- 계절성분

## 원시계열에서 추세성분 조정

adjtrend_ = export-hat_Tt

plot.ts(adjtrend_, lwd=2)

y = factor(cycle(adjtrend_))

fit1 <- lm(adjtrend_ ~ 0+y) # 제약조건 beta0=0

summary(fit1)

Call:

lm(formula = adjtrend_ ~ 0 + y)

Residuals:

Min 1Q Median 3Q Max

-10.5684 -2.4909 0.0174 2.5296 9.4910

Coefficients:

Estimate Std. Error t value Pr(>|t|)

y1 -8.9845 1.5237 -5.897 1.03e-07 ***

y2 -7.2747 1.5237 -4.774 8.87e-06 ***

y3 0.2649 1.6289 0.163 0.8713

y4 -1.5889 1.6289 -0.975 0.3325

y5 0.3345 1.6289 0.205 0.8379

y6 3.9893 1.6289 2.449 0.0167 *

y7 0.1784 1.6289 0.110 0.9131

y8 -1.2583 1.6289 -0.772 0.4423

y9 2.0722 1.6289 1.272 0.2073

y10 1.6756 1.6289 1.029 0.3070

y11 3.3590 1.6289 2.062 0.0427 *

y12 9.5552 1.6289 5.866 1.17e-07 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 4.31 on 74 degrees of freedom

Multiple R-squared: 0.5901, Adjusted R-squared: 0.5236

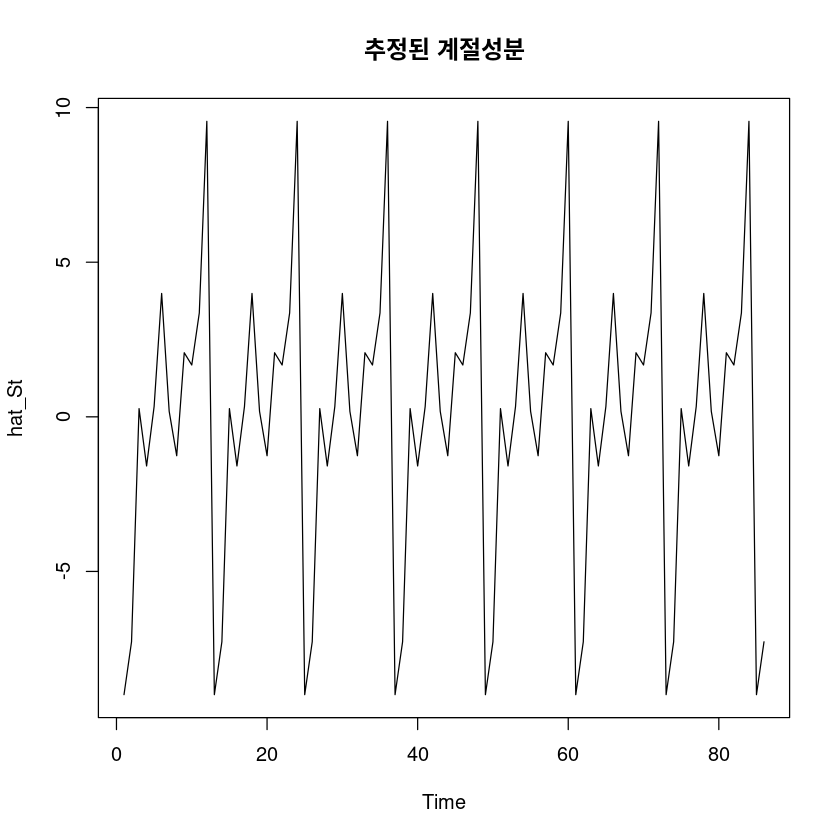

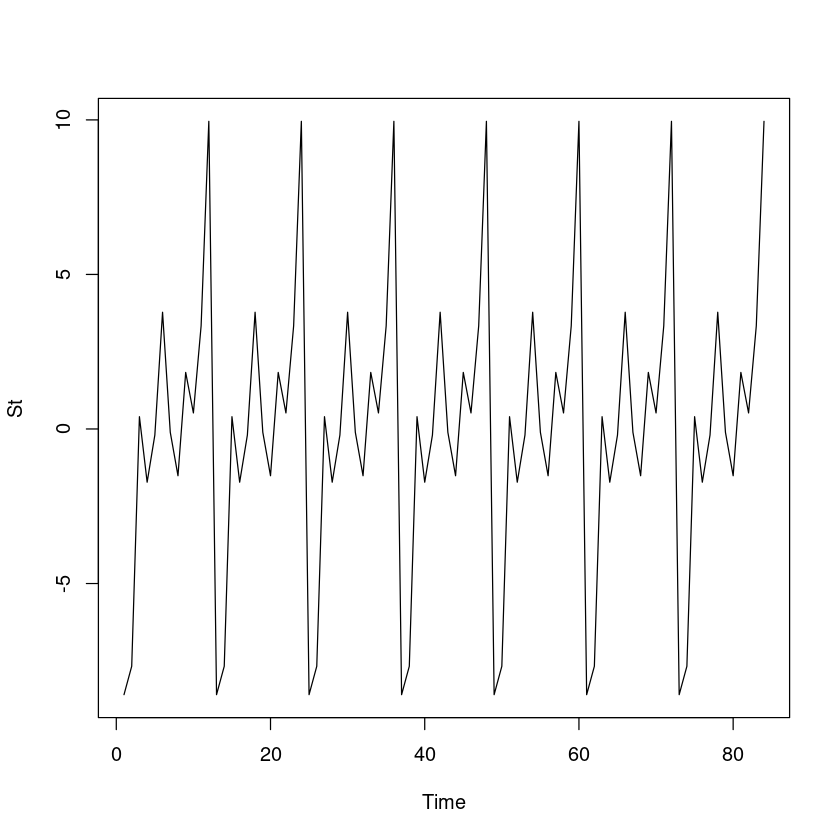

F-statistic: 8.878 on 12 and 74 DF, p-value: 3.121e-10\(\hat S_t = -8.9845 I_1 + \dots +9.5552I_{12}\)

hat_St <- fitted(fit1)

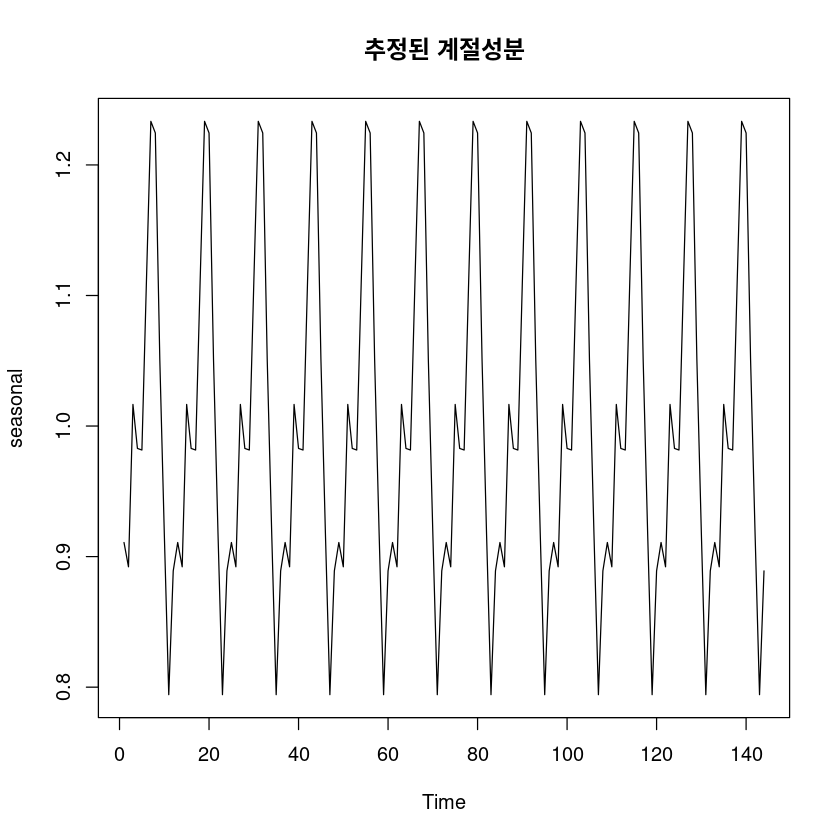

ts.plot(hat_St, main="추정된 계절성분")

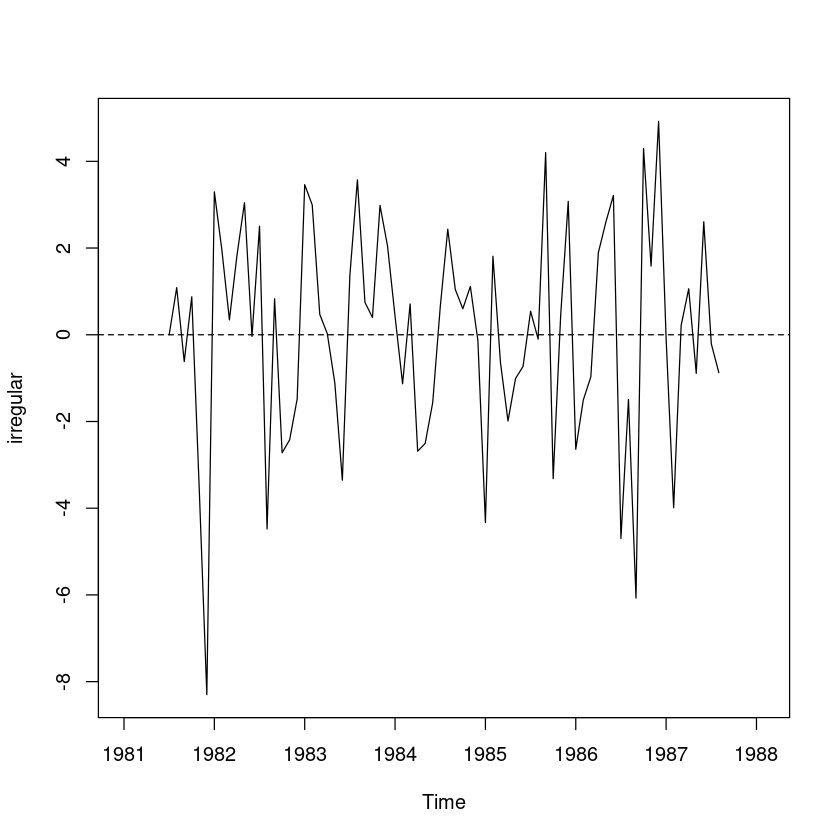

- 불규칙성분

hat_It <- export - hat_Tt - hat_St

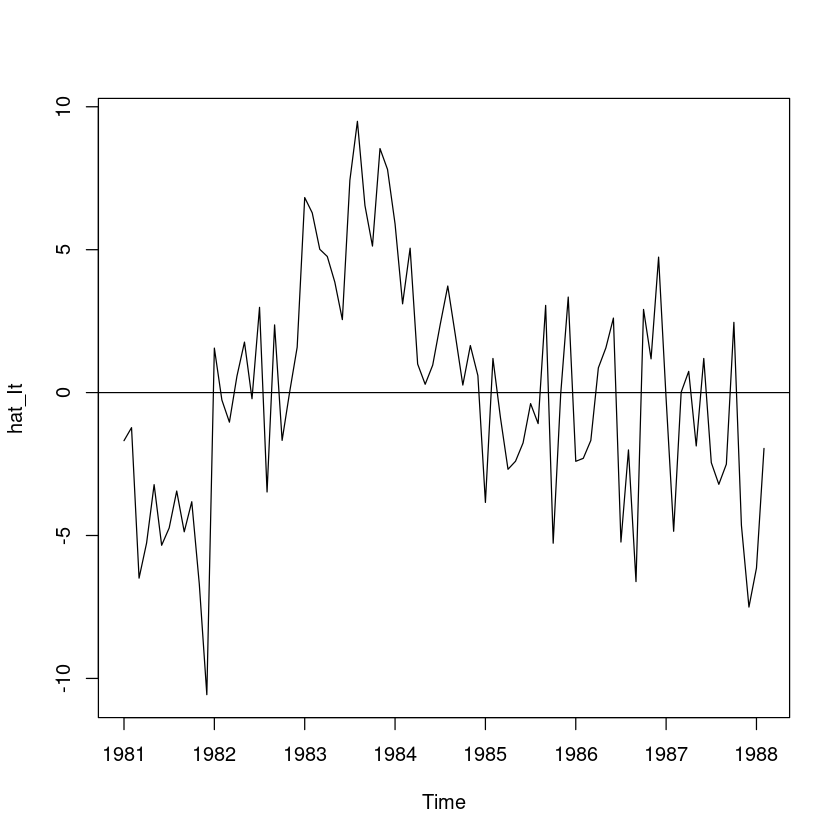

ts.plot(hat_It); abline(h=0)

- 추정

pred_a <- hat_Tt + hat_St

ts.plot(export, pred_a, col=1:2, lty=1:2, lwd=2:3,ylab="export", xlab="time")

sum((export-pred_a)^2)(2)

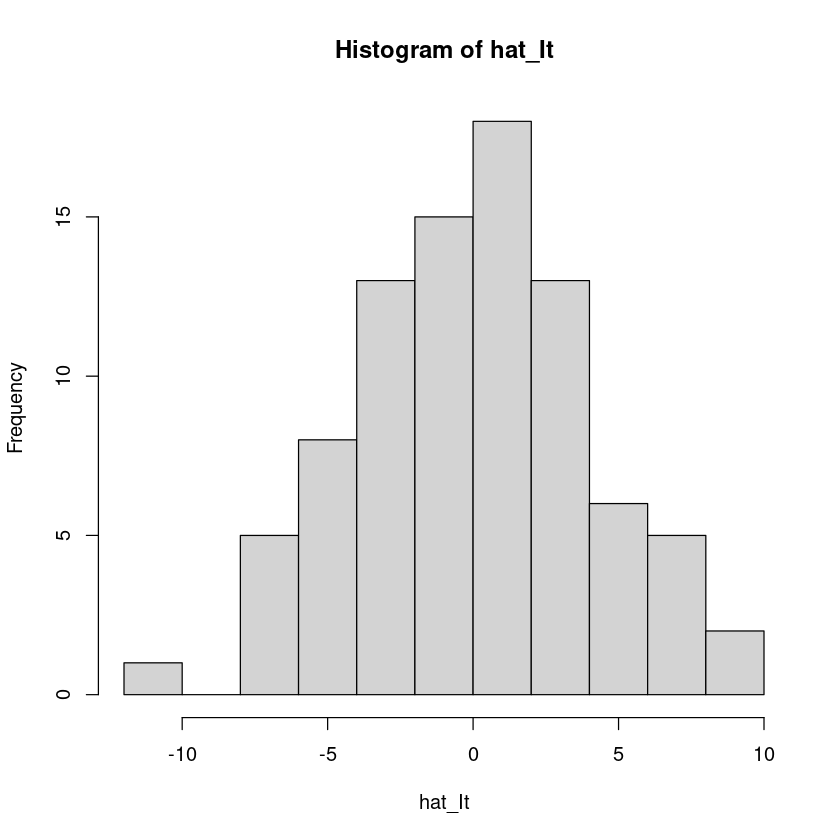

추정된 불규칙성분의 분석을 통해 적용된 분해법이 적절했는지 논하여라.

t.test(hat_It) #H0 : mu=E(It)=0

One Sample t-test

data: hat_It

t = 8.2505e-16, df = 85, p-value = 1

alternative hypothesis: true mean is not equal to 0

95 percent confidence interval:

-0.8621323 0.8621323

sample estimates:

mean of x

3.577489e-16 - 평균이 0이다.

hist(hat_It)

dwtest(lm(hat_It~ t),

alternative = 'two.sided')

Durbin-Watson test

data: lm(hat_It ~ t)

DW = 0.79194, p-value = 1.672e-10

alternative hypothesis: true autocorrelation is not 0양의 상관관계가 있어보인다.

bptest(lm(hat_It ~ t, data = export))

studentized Breusch-Pagan test

data: lm(hat_It ~ t, data = export)

BP = 4.276, df = 1, p-value = 0.03865(3)

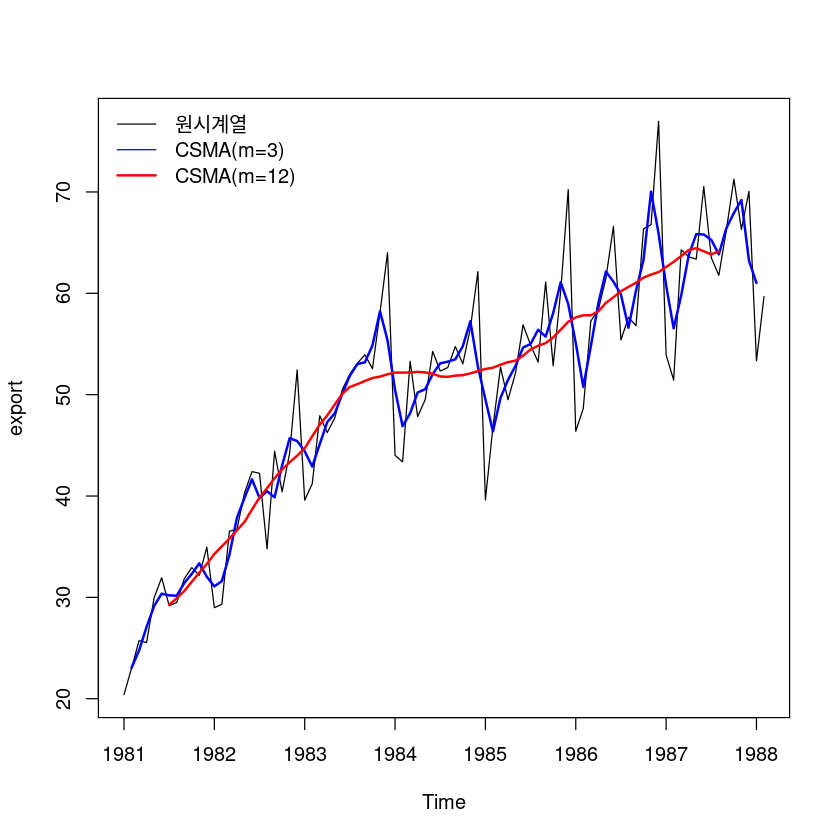

이동평균을 이용한 분해법에 의한 각 성분의 시계열 그림을 그려라

이동평균분해법

z <- scan("export.txt")

t <- 1:length(z)

export <- ts(z, start=c(1981,1), frequency=12)

#plot.ts(export, lwd=2, main="TS plot for export data")

plot.ts(export)

lines(ma(export,3), col='blue', lwd=2)

lines(ma(export,12), col='red', lwd=2)

legend('topleft', lty=c(1,1,1), col=c('black', 'blue', 'red'),

lwd=c(1,1,2),

c('원시계열', "CSMA(m=3)", "CSMA(m=12)"),

bty='n')

trend = ma(export, 12)

plot.ts(trend, lwd=2)

adj_trend <-export - trend

plot.ts(adj_trend, lwd=2)

seasonal <- tapply(adj_trend, cycle(adj_trend), function(y) mean(y,na.rm=T))

seasonal- 1

- -8.57347222222222

- 2

- -7.65451388888889

- 3

- 0.41888888888889

- 4

- -1.69965277777778

- 5

- -0.174375000000001

- 6

- 3.79819444444445

- 7

- -0.0849999999999983

- 8

- -1.4907738095238

- 9

- 1.85138888888889

- 10

- 0.540972222222225

- 11

- 3.35631944444444

- 12

- 9.97465277777778

summary(lm(adj_trend~0+as.factor(cycle(adj_trend))))

Call:

lm(formula = adj_trend ~ 0 + as.factor(cycle(adj_trend)))

Residuals:

Min 1Q Median 3Q Max

-8.3226 -1.4141 0.3492 1.8005 4.9008

Coefficients:

Estimate Std. Error t value Pr(>|t|)

as.factor(cycle(adj_trend))1 -8.5735 1.1268 -7.608 1.89e-10 ***

as.factor(cycle(adj_trend))2 -7.6545 1.1268 -6.793 4.90e-09 ***

as.factor(cycle(adj_trend))3 0.4189 1.1268 0.372 0.71135

as.factor(cycle(adj_trend))4 -1.6997 1.1268 -1.508 0.13654

as.factor(cycle(adj_trend))5 -0.1744 1.1268 -0.155 0.87752

as.factor(cycle(adj_trend))6 3.7982 1.1268 3.371 0.00129 **

as.factor(cycle(adj_trend))7 -0.0850 1.0432 -0.081 0.93533

as.factor(cycle(adj_trend))8 -1.4908 1.0432 -1.429 0.15803

as.factor(cycle(adj_trend))9 1.8514 1.1268 1.643 0.10544

as.factor(cycle(adj_trend))10 0.5410 1.1268 0.480 0.63286

as.factor(cycle(adj_trend))11 3.3563 1.1268 2.979 0.00413 **

as.factor(cycle(adj_trend))12 9.9747 1.1268 8.852 1.33e-12 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 2.76 on 62 degrees of freedom

(12 observations deleted due to missingness)

Multiple R-squared: 0.7721, Adjusted R-squared: 0.728

F-statistic: 17.5 on 12 and 62 DF, p-value: 1.335e-15mean(seasonal)seasonal <- seasonal - mean(seasonal) #평균을 0으로 수정

seasonal- 1

- -8.59535796957672

- 2

- -7.67639963624339

- 3

- 0.397003141534391

- 4

- -1.72153852513228

- 5

- -0.1962607473545

- 6

- 3.77630869708995

- 7

- -0.106885747354497

- 8

- -1.5126595568783

- 9

- 1.82950314153439

- 10

- 0.519086474867726

- 11

- 3.33443369708995

- 12

- 9.95276703042328

St = rep(seasonal, 7)

plot.ts(St)

irregular <- export - trend - St

plot.ts(irregular)

abline(h=0, lty=2)Warning message in `-.default`(export - trend, St):

“longer object length is not a multiple of shorter object length”

decompose 함수 이용

dec_fit <- decompose(export, 'additive')

dec_fit$x

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

1981 20.40 23.01 25.73 25.55 29.96 31.94 29.18 29.48 31.83 32.93 32.18 34.95

1982 28.98 29.32 36.53 36.73 40.29 42.41 42.24 34.79 44.41 40.42 44.24 52.45

1983 39.59 41.21 47.92 46.26 47.73 50.52 52.03 53.10 53.93 52.56 58.10 64.01

1984 44.01 43.37 53.30 47.84 49.50 54.27 52.33 52.68 54.75 53.04 56.55 62.14

1985 39.61 46.80 52.71 49.50 52.15 56.89 54.90 53.21 61.12 52.85 60.20 70.23

1986 46.39 48.65 57.26 58.39 61.46 66.60 55.40 57.63 56.80 66.37 66.77 76.97

1987 53.92 51.44 64.29 63.61 63.37 70.53 63.52 61.77 66.25 71.26 66.29 70.07

1988 53.34 59.68

$seasonal

Jan Feb Mar Apr May Jun

1981 -8.5953580 -7.6763996 0.3970031 -1.7215385 -0.1962607 3.7763087

1982 -8.5953580 -7.6763996 0.3970031 -1.7215385 -0.1962607 3.7763087

1983 -8.5953580 -7.6763996 0.3970031 -1.7215385 -0.1962607 3.7763087

1984 -8.5953580 -7.6763996 0.3970031 -1.7215385 -0.1962607 3.7763087

1985 -8.5953580 -7.6763996 0.3970031 -1.7215385 -0.1962607 3.7763087

1986 -8.5953580 -7.6763996 0.3970031 -1.7215385 -0.1962607 3.7763087

1987 -8.5953580 -7.6763996 0.3970031 -1.7215385 -0.1962607 3.7763087

1988 -8.5953580 -7.6763996

Jul Aug Sep Oct Nov Dec

1981 -0.1068857 -1.5126596 1.8295031 0.5190865 3.3344337 9.9527670

1982 -0.1068857 -1.5126596 1.8295031 0.5190865 3.3344337 9.9527670

1983 -0.1068857 -1.5126596 1.8295031 0.5190865 3.3344337 9.9527670

1984 -0.1068857 -1.5126596 1.8295031 0.5190865 3.3344337 9.9527670

1985 -0.1068857 -1.5126596 1.8295031 0.5190865 3.3344337 9.9527670

1986 -0.1068857 -1.5126596 1.8295031 0.5190865 3.3344337 9.9527670

1987 -0.1068857 -1.5126596 1.8295031 0.5190865 3.3344337 9.9527670

1988

$trend

Jan Feb Mar Apr May Jun Jul Aug

1981 NA NA NA NA NA NA 29.28583 29.90625

1982 34.27833 35.04375 35.78917 36.62542 37.44000 38.67167 39.84292 40.78042

1983 44.72292 45.89375 47.05333 47.95583 49.03917 50.09833 50.76417 51.03833

1984 52.18083 52.17583 52.19250 52.24667 52.20208 52.05958 51.79833 51.75792

1985 52.53625 52.66542 52.95292 53.21042 53.35458 53.84375 54.46333 54.82292

1986 57.62583 57.83083 57.83500 58.21833 59.05542 59.61000 60.20458 60.63458

1987 62.59667 63.10750 63.67375 64.27125 64.45500 64.14750 63.83583 64.15500

1988 NA NA

Sep Oct Nov Dec

1981 30.61917 31.53500 32.43125 33.29792

1982 41.75042 42.62208 43.32917 43.97708

1983 51.35250 51.64250 51.78208 52.01208

1984 51.87625 51.92083 52.10042 52.32000

1985 55.08958 55.64958 56.40792 57.20042

1986 61.04375 61.55417 61.85125 62.09458

1987 NA NA NA NA

1988

$random

Jan Feb Mar Apr May

1981 NA NA NA NA NA

1982 3.297024636 1.952649636 0.343830192 1.826121858 3.046260747

1983 3.462441303 2.992649636 0.469663525 0.025705192 -1.112905919

1984 0.424524636 -1.129433697 0.710496858 -2.685128142 -2.505822586

1985 -4.330892030 1.810982970 -0.639919808 -1.988878142 -1.008322586

1986 -2.640475364 -1.504433697 -0.972003142 1.893205192 2.600844081

1987 -0.081308697 -3.991100364 0.219246858 1.060288525 -0.888739253

1988 NA NA

Jun Jul Aug Sep Oct

1981 NA 0.001052414 1.086409557 -0.618669808 0.875913525

1982 -0.037975364 2.503969081 -4.477757110 0.830080192 -2.721169808

1983 -3.354642030 1.372719081 3.574326224 0.747996858 0.398413525

1984 -1.565892030 0.638552414 2.434742890 1.044246858 0.600080192

1985 -0.730058697 0.543552414 -0.100257110 4.200913525 -3.318669808

1986 3.213691303 -4.697697586 -1.491923776 -6.073253142 4.296746858

1987 2.606191303 -0.208947586 -0.872340443 NA NA

1988

Nov Dec

1981 -3.585683697 -8.300683697

1982 -2.423600364 -1.479850364

1983 2.983482970 2.045149636

1984 1.115149636 -0.132767030

1985 0.457649636 3.076816303

1986 1.584316303 4.922649636

1987 NA NA

1988

$figure

[1] -8.5953580 -7.6763996 0.3970031 -1.7215385 -0.1962607 3.7763087

[7] -0.1068857 -1.5126596 1.8295031 0.5190865 3.3344337 9.9527670

$type

[1] "additive"

attr(,"class")

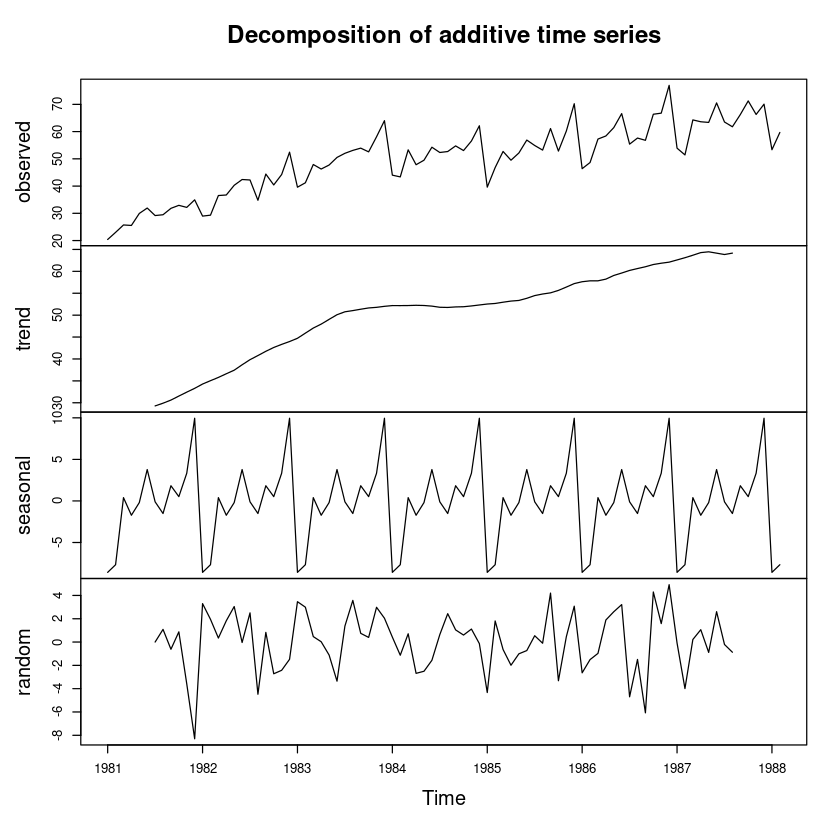

[1] "decomposed.ts"plot(dec_fit)

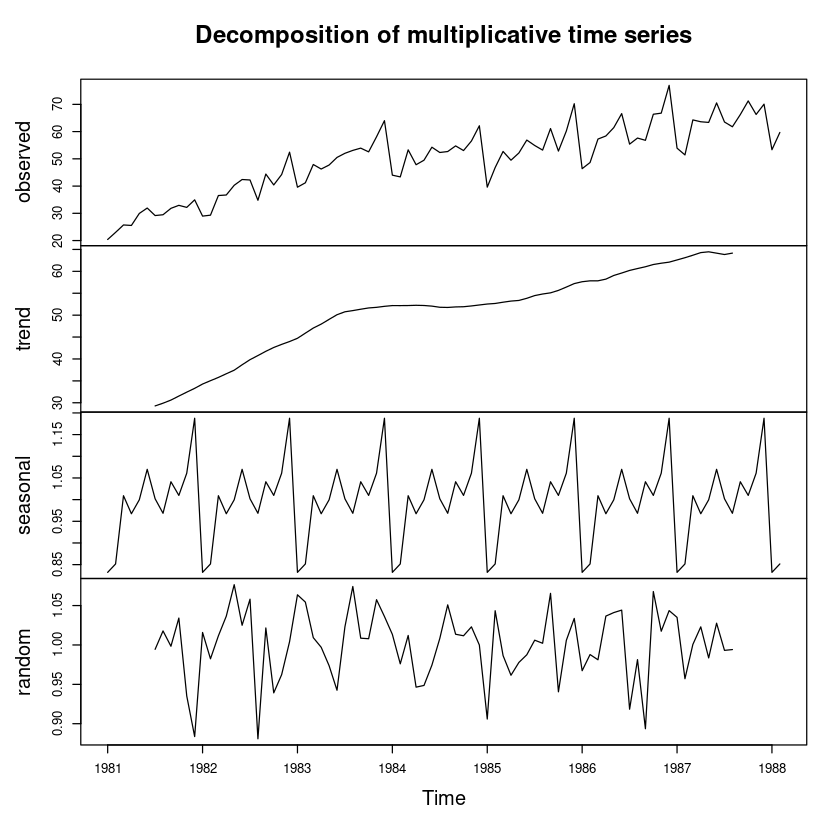

dec_fit2 <- decompose(export, type = "multiplicative")

plot(dec_fit2)

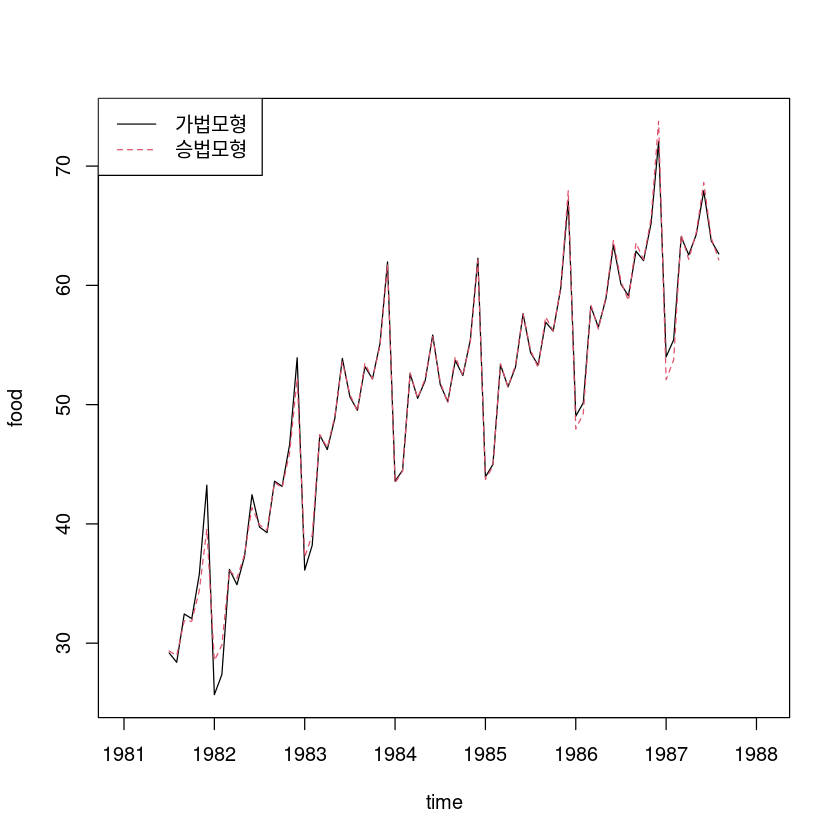

## 가법모형 vs. 승법모형

pred_dec <-dec_fit$trend+dec_fit$seasonal

pred_dec2 <-dec_fit2$trend*dec_fit2$seasonal

ts.plot(pred_dec, pred_dec2, col=1:2, lty=1:2, ylab="food", xlab="time")

legend("topleft", lty=1:2, col=1:2, c("가법모형", "승법모형"))

stl함수 이용

stl_fit1 <- stl(export, s.window=12)

stl_fit1 Call:

stl(x = export, s.window = 12)

Components

seasonal trend remainder

Jan 1981 -8.03824134 26.81776 1.620485206

Feb 1981 -6.63002814 27.30969 2.330333480

Mar 1981 -0.13110622 27.80163 -1.940526967

Apr 1981 -2.16782904 28.29357 -0.575742678

May 1981 -0.02387280 28.83742 1.146455416

Jun 1981 3.12006392 29.38126 -0.561326978

Jul 1981 0.19259616 29.92511 -0.937704893

Aug 1981 -1.39615399 30.52457 0.351588714

Sep 1981 2.08889246 31.12402 -1.382914272

Oct 1981 0.78594126 31.72348 0.420580381

Nov 1981 3.14306515 32.53144 -3.494505630

Dec 1981 9.25329283 33.33940 -7.642695428

Jan 1982 -8.18853645 34.14736 3.021171726

Feb 1982 -6.74205914 35.02084 1.041217119

Mar 1982 -0.11359668 35.89432 0.749277352

Apr 1982 -2.14642909 36.76780 2.108632461

May 1982 -0.04765717 37.74653 2.591125433

Jun 1982 3.22089766 38.72527 0.463835494

Jul 1982 0.10549237 39.70400 2.430505678

Aug 1982 -1.41993463 40.61875 -4.408810621

Sep 1982 2.04045104 41.53349 0.836060406

Oct 1982 0.89651488 42.44823 -2.924746731

Nov 1982 3.20038177 43.30548 -2.265858677

Dec 1982 9.40282354 44.16272 -1.115545502

Jan 1983 -8.33955445 45.01997 2.909587433

Feb 1983 -6.85397510 46.00456 2.059414793

Mar 1983 -0.09513416 46.98915 1.025980554

Apr 1983 -2.12310901 47.97375 0.409362112

May 1983 -0.06855425 48.79308 -0.994521923

Jun 1983 3.32542520 49.61241 -2.417830650

Jul 1983 0.02288888 50.43173 1.575376391

Aug 1983 -1.43898388 50.82162 3.717366595

Sep 1983 1.99697212 51.21150 0.721528047

Oct 1983 1.01133498 51.60138 -0.052717360

Nov 1983 3.26122886 51.76546 3.073314934

Dec 1983 9.55393181 51.92953 2.526538154

Jan 1984 -8.63020919 52.09360 0.546605321

Feb 1984 -7.05228753 52.10779 -1.685505543

Mar 1984 -0.02362451 52.12198 1.201642230

Apr 1984 -2.05361665 52.13617 -2.242554829

May 1984 -0.12808589 52.06895 -2.440860110

Jun 1984 3.51447214 52.00172 -1.246192660

Jul 1984 -0.10905922 51.93450 0.504564171

Aug 1984 -1.46691120 51.96370 2.183207296

Sep 1984 1.91927553 51.99291 0.837811709

Oct 1984 1.27127927 52.02212 -0.253400890

Nov 1984 3.36913024 52.18801 0.992858614

Dec 1984 9.78170407 52.35390 0.004395256

Jan 1985 -8.94600253 52.51979 -3.963787671

Feb 1985 -7.27425538 52.75254 1.321719247

Mar 1985 0.02571289 52.98528 -0.300994963

Apr 1985 -2.00432115 53.21803 -1.713706857

May 1985 -0.20583899 53.58938 -1.233544814

Jun 1985 3.68735310 53.96074 -0.758092699

Jul 1985 -0.25511780 54.33210 0.823022411

Aug 1985 -1.50687743 54.83525 -0.118367709

Sep 1985 1.83161162 55.33839 3.949993500

Oct 1985 1.52356468 55.84154 -4.515109315

Nov 1985 3.47168119 56.34545 0.382869321

Dec 1985 10.00699125 56.84935 3.373654404

Jan 1986 -9.17170413 57.35326 -1.791555078

Feb 1986 -7.34995073 57.74972 -1.749772497

Mar 1986 0.01792431 58.14619 -0.904111549

Apr 1986 -2.00925233 58.54265 1.856601080

May 1986 -0.25578936 59.05157 2.664216221

Jun 1986 3.77379354 59.56050 3.265711445

Jul 1986 -0.35038247 60.06942 -4.319034430

Aug 1986 -1.52477949 60.53012 -1.375341107

Sep 1986 1.78721730 60.99082 -5.978041605

Oct 1986 1.64995719 61.45153 3.268514805

Nov 1986 3.51677071 61.86477 1.388457561

Dec 1986 10.11358765 62.27802 4.578396895

Jan 1987 -9.37155076 62.69126 0.600291580

Feb 1987 -7.40218241 63.09442 -4.252233068

Mar 1987 0.03120809 63.49757 0.761220146

Apr 1987 -1.99625213 63.90073 1.705524066

May 1987 -0.29094930 63.96479 -0.303838557

Jun 1987 3.87191769 64.02885 2.629234647

Jul 1987 -0.43707012 64.09291 -0.135837345

Aug 1987 -1.53661763 64.17446 -0.867840726

Sep 1987 1.74637383 64.25601 0.247616920

Oct 1987 1.77824626 64.33756 5.144193599

Nov 1987 3.56210251 64.39946 -1.671565286

Dec 1987 10.21967043 64.46137 -4.611035849

Jan 1988 -9.50110743 64.52327 -1.682160623

Feb 1988 -7.47541608 64.56485 2.590568880plot(stl_fit1)

pred_stl <- stl_fit1$time.series[,1]+stl_fit1$time.series[,2](4)

추정된 불규칙성분의 분석을 통해 적용된 분해법이 적절했는지 논하여라.

t.test(irregular)

One Sample t-test

data: irregular

t = 0.074013, df = 73, p-value = 0.9412

alternative hypothesis: true mean is not equal to 0

95 percent confidence interval:

-0.5674456 0.6112171

sample estimates:

mean of x

0.02188575 dwtest(lm(irregular~1))

Durbin-Watson test

data: lm(irregular ~ 1)

DW = 1.9469, p-value = 0.4094

alternative hypothesis: true autocorrelation is greater than 0dwtest(lm(irregular~t))

Durbin-Watson test

data: lm(irregular ~ t)

DW = 1.9477, p-value = 0.3643

alternative hypothesis: true autocorrelation is greater than 0추정

fit_ <- trend + St

ts.plot(export, fit_, lty=1:2, col=1:2, lwd=2:3)Warning message in `+.default`(trend, St):

“longer object length is not a multiple of shorter object length”

(5)

각 분해법에 의한 결과를 1-시착 후 예측오차의 제곱합 (SSE) 기준하에서 2번의 결과와 예측 력을 비교하여라.

- decompose

sum((export-pred_dec)^2, na.rm=T) #SSE - 가법

sum((export-pred_dec2)^2, na.rm=T) #SSE - 승법- stl

sum((export-pred_stl)^2) 5

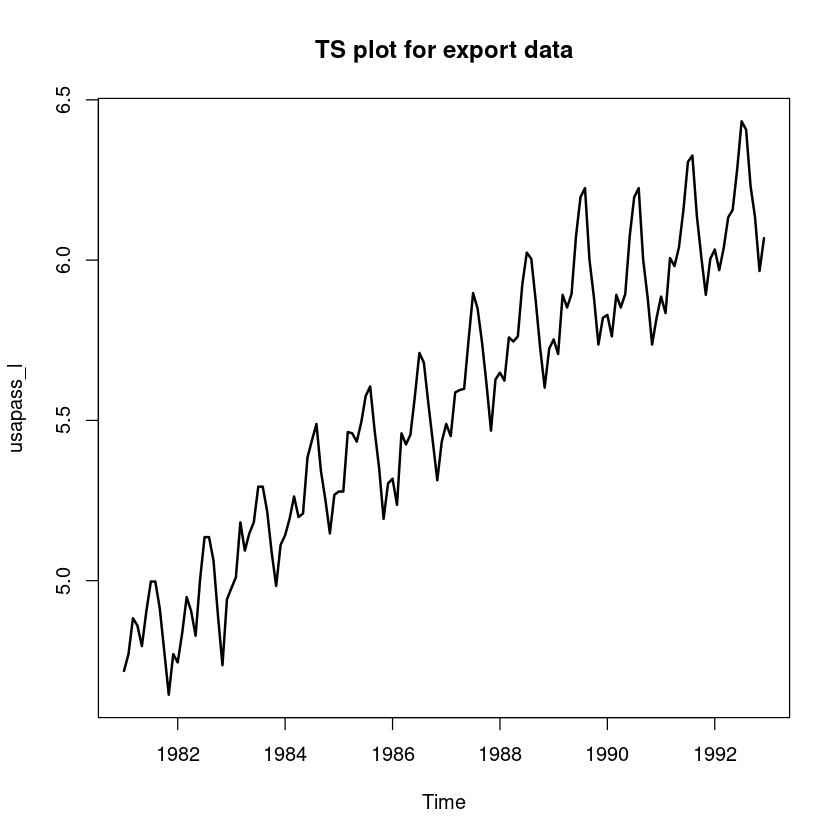

(R 실습) ’usapass.txt’는 미국 월별 비행기 승객 수(단위 : 천 명)의 시계열자료이다. log 변환 후 아래의 분석을 수행하시오. ((2),(3),(4)번에 대하여 모형을 적합한 후 실제데이터와 각 모형에서 구해진 추정값을 비교하는 그림도 포함)

z5 <- scan("usapass.txt")

t <- 1:length(z5)

usapass <- ts(z5, start=c(1981,1), frequency=12)

plot.ts(usapass, lwd=2, main="TS plot for export data")

usapass_l <- ts(log(z5), start=c(1981,1), frequency=12)

plot.ts(usapass_l, lwd=2, main="TS plot for export data")

(1)

왜 log 변환이 필요한지에 대해 간단히 설명하여라.

시도표를 확인하면 시간에 따라 분산이 커지는 것을 볼수 있다. 이는 모델의 결과가 잘못된 값이 나올 수 있다.

(2)

적절한 추세 모형을 적합시킨 후 잔차분석을 하여라.

z5_ts <- ts(z5, frequency=12)

cycle(z5_ts)| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 2 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 3 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 4 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 5 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 6 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 7 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 8 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 9 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 10 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 11 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 12 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

seasonal_I <- as.factor(cycle(z5_ts))

t <- 1:length(z5)

m3 <- lm(log(z5)~t+seasonal_I)summary(m3)

Call:

lm(formula = log(z5) ~ t + seasonal_I)

Residuals:

Min 1Q Median 3Q Max

-0.159814 -0.044426 0.000623 0.045572 0.151846

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 4.7246982 0.0198289 238.274 < 2e-16 ***

t 0.0100999 0.0001252 80.666 < 2e-16 ***

seasonal_I2 -0.0220859 0.0254094 -0.869 0.38633

seasonal_I3 0.1095029 0.0254104 4.309 3.19e-05 ***

seasonal_I4 0.0768102 0.0254119 3.023 0.00302 **

seasonal_I5 0.0762636 0.0254141 3.001 0.00322 **

seasonal_I6 0.1990500 0.0254168 7.831 1.45e-12 ***

seasonal_I7 0.3049668 0.0254202 11.997 < 2e-16 ***

seasonal_I8 0.2976260 0.0254242 11.706 < 2e-16 ***

seasonal_I9 0.1461189 0.0254289 5.746 6.08e-08 ***

seasonal_I10 0.0110851 0.0254341 0.436 0.66367

seasonal_I11 -0.1341418 0.0254399 -5.273 5.39e-07 ***

seasonal_I12 -0.0214153 0.0254464 -0.842 0.40156

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 0.06224 on 131 degrees of freedom

Multiple R-squared: 0.982, Adjusted R-squared: 0.9803

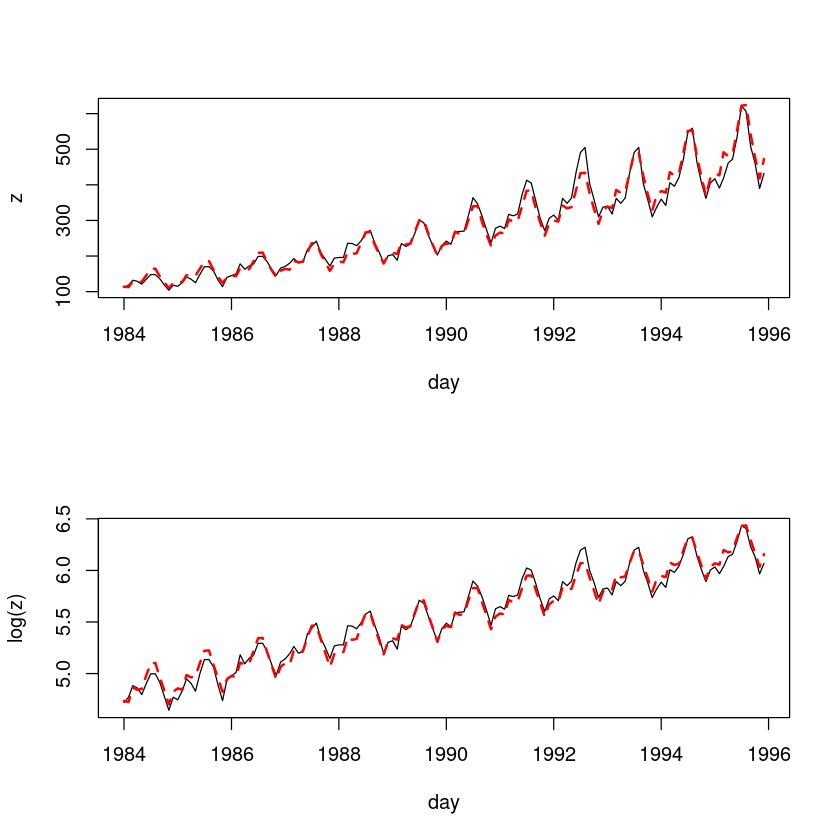

F-statistic: 594.1 on 12 and 131 DF, p-value: < 2.2e-16- 적합된 모형: \(\hat Z_t = 4.72 + 0.01t - 0.022I_{t2} + \dots - 0.021 I_{t12}\)

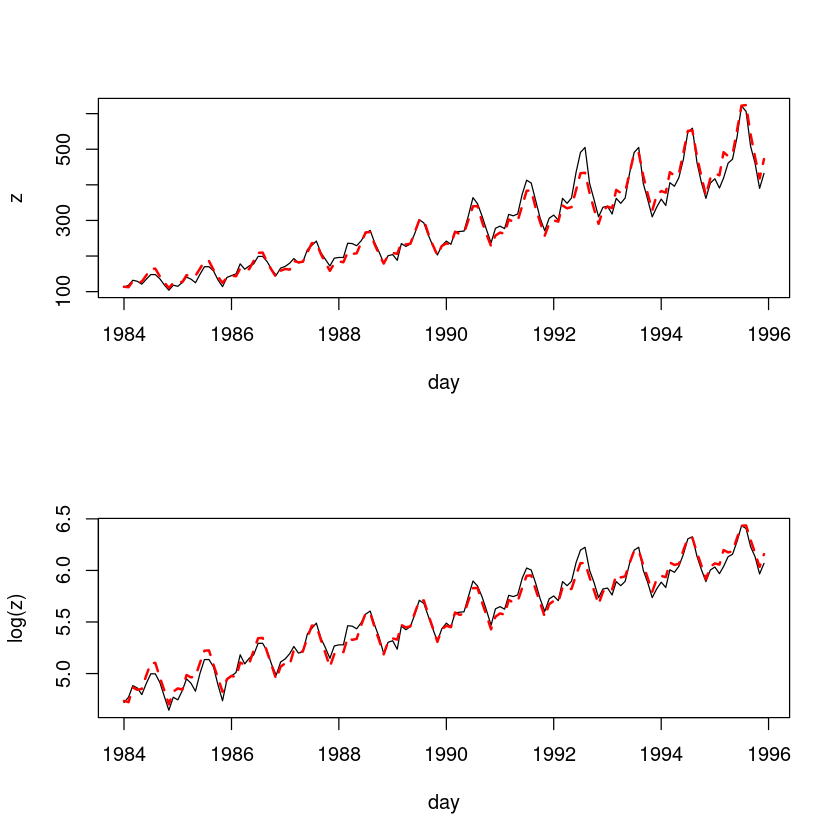

tmp.data <- data.frame(

day = seq(ymd("1984-01-01"),

by='1 month', length.out=length(z5)),

z=z5

)

par(mfrow=c(2,1))

plot(z~day, tmp.data, type='l')

lines(tmp.data$day, exp(fitted(m3)), col='red', lty=2, lwd=2) # m3에 exp함수 처리

plot(log(z)~day, tmp.data, type='l')

lines(tmp.data$day, fitted(m3), col='red', lty=2, lwd=2)

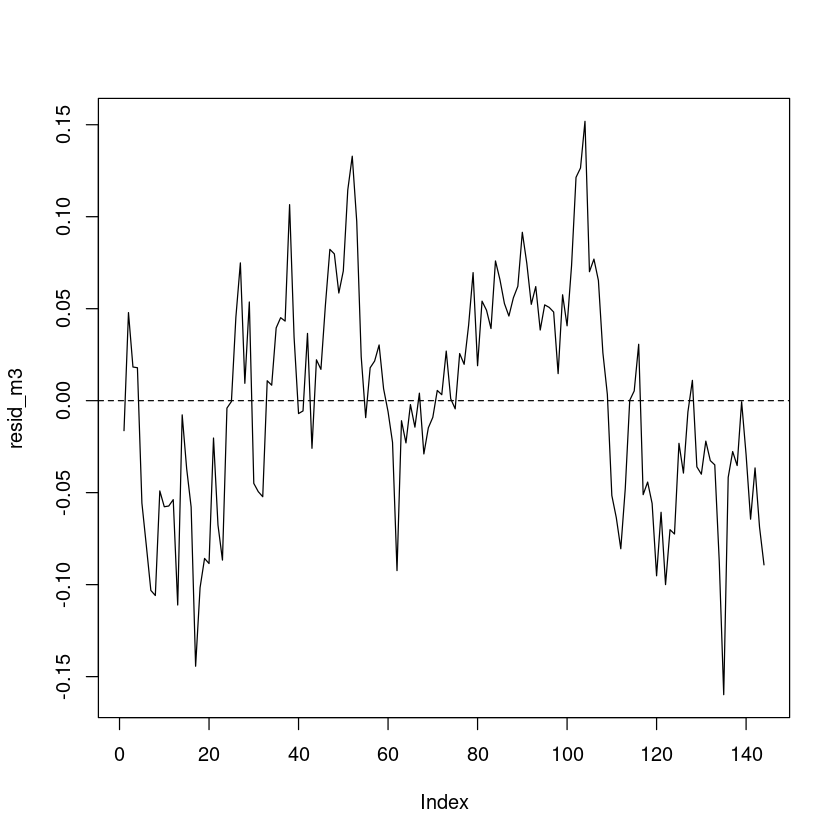

resid_m3 <- resid(m3)

plot(resid_m3, pch=16, type='l')

abline(h=0, lty=2)

t.test(resid_m3)

One Sample t-test

data: resid_m3

t = 1.4082e-16, df = 143, p-value = 1

alternative hypothesis: true mean is not equal to 0

95 percent confidence interval:

-0.009812747 0.009812747

sample estimates:

mean of x

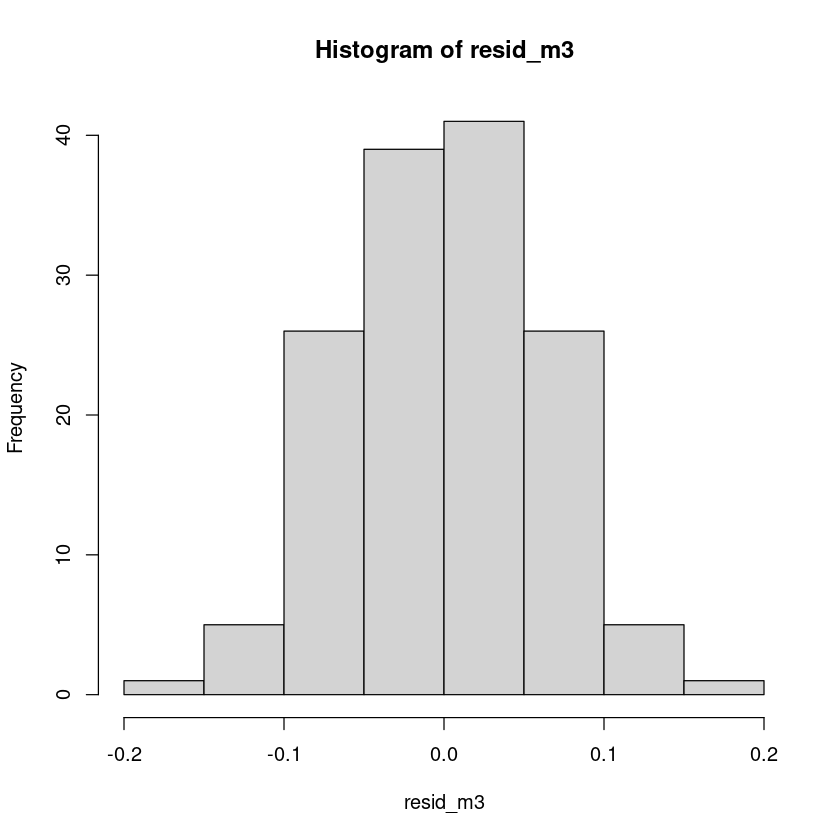

6.990845e-19 hist(resid_m3)

lmtest::bptest(m3)

studentized Breusch-Pagan test

data: m3

BP = 5.9163, df = 12, p-value = 0.9202lmtest::dwtest(m3, alternative="two.sided")

Durbin-Watson test

data: m3

DW = 0.40831, p-value < 2.2e-16

alternative hypothesis: true autocorrelation is not 0sum((summary(m3)$residual)^2)(3)

적절한 평활법을 적용한 후 잔차분석을 하여라.

가법모형

fit_hw_l <- HoltWinters(usapass_l, seasonal="additive")fit_hw_lHolt-Winters exponential smoothing with trend and additive seasonal component.

Call:

HoltWinters(x = usapass_l, seasonal = "additive")

Smoothing parameters:

alpha: 0.3447498

beta : 0.003585913

gamma: 0.879488

Coefficients:

[,1]

a 6.165298459

b 0.008744433

s1 -0.073696849

s2 -0.142822821

s3 -0.039964334

s4 0.015968620

s5 0.033673237

s6 0.157016140

s7 0.300626468

s8 0.285698068

s9 0.098491289

s10 -0.021898771

s11 -0.190036243

s12 -0.096734648

par(mfrow=c(2,1))

plot(z~day, tmp.data, type='l')

lines(tmp.data$day, exp(fitted(m3)), col='red', lty=2, lwd=2) # m3에 exp함수 처리

plot(log(z)~day, tmp.data, type='l')

lines(tmp.data$day, fitted(m3), col='red', lty=2, lwd=2)

fit6= hw(usapass_l,

alpha = fit_hw_l$alpha,

beta = fit_hw_l$beta,

gamma = fit_hw_l$gamma,

seasonal="additive",

initial="simple",

h=12)

fit6$modelHolt-Winters' additive method

Call:

hw(y = usapass_l, h = 12, seasonal = "additive", initial = "simple",

Call:

alpha = fit_hw_l$alpha, beta = fit_hw_l$beta, gamma = fit_hw_l$gamma)

Smoothing parameters:

alpha = 0.3447

beta = 0.0036

gamma = 0.8795

Initial states:

l = 4.8362

b = 0.0079

s = -0.0655 -0.1918 -0.0571 0.0765 0.161 0.161

0.0691 -0.0404 0.0236 0.0466 -0.0655 -0.1177

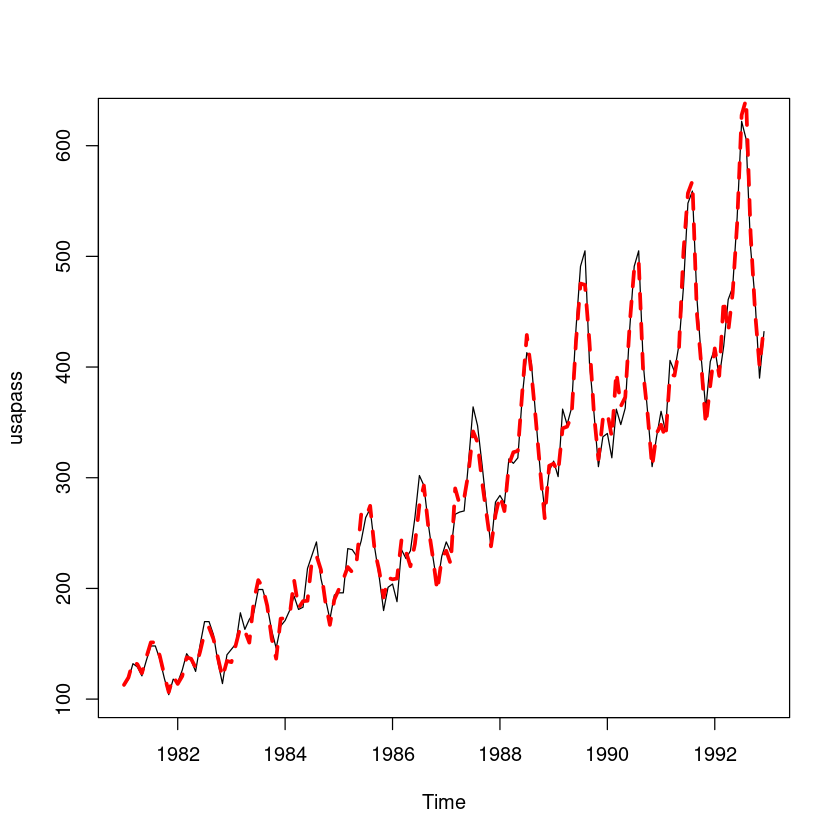

sigma: 0.0425- 원데이터와 비교그림 넣어주기 위해서 exp취해줌

plot(usapass)

lines(exp(fit6$fitted), lwd=3, col='red', lty=2)

ts.plot(fit6$residual, ylab="residual",

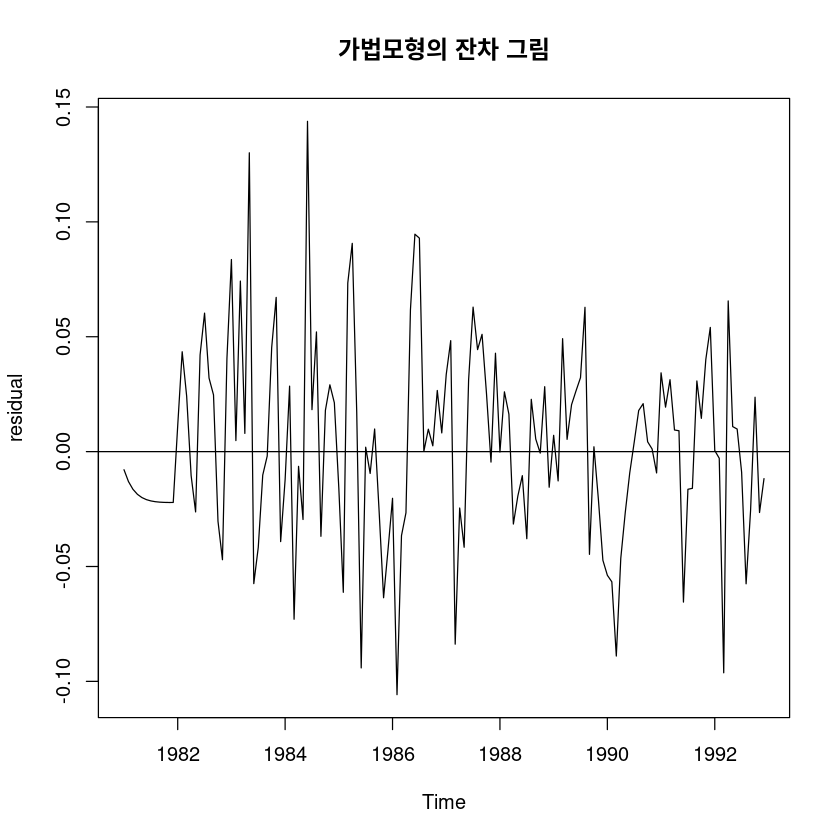

main="가법모형의 잔차 그림"); abline(h=0)

t.test(fit6$residual)

One Sample t-test

data: fit6$residual

t = 0.72402, df = 143, p-value = 0.4702

alternative hypothesis: true mean is not equal to 0

95 percent confidence interval:

-0.004441394 0.009575433

sample estimates:

mean of x

0.002567019 dwtest(lm(fit6$residual~1), alternative = 'two.sided')

Durbin-Watson test

data: lm(fit6$residual ~ 1)

DW = 1.5421, p-value = 0.005659

alternative hypothesis: true autocorrelation is not 0승법모형(원데이터로 진행해봄)

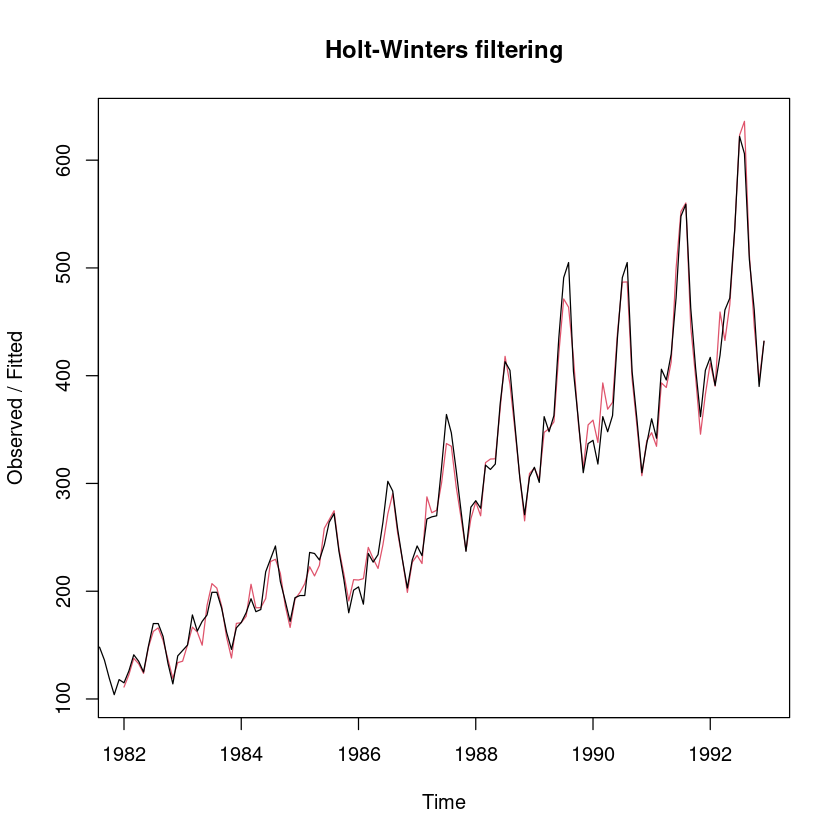

fit_hw_m <- HoltWinters(usapass, seasonal="multiplicative")plot(fit_hw_m)

fit7= hw(usapass,

alpha = fit_hw_m$alpha,

beta = fit_hw_m$beta,

gamma = fit_hw_m$gamma,

seasonal="multiplicative",

initial="simple",

h=12)

fit7$modelHolt-Winters' multiplicative method

Call:

hw(y = usapass, h = 12, seasonal = "multiplicative", initial = "simple",

Call:

alpha = fit_hw_m$alpha, beta = fit_hw_m$beta, gamma = fit_hw_m$gamma)

Smoothing parameters:

alpha = 0.3205

beta = 0.0239

gamma = 1

Initial states:

l = 126.6667

b = 1.0833

s = 0.9316 0.8211 0.9395 1.0737 1.1684 1.1684

1.0658 0.9553 1.0184 1.0421 0.9316 0.8842

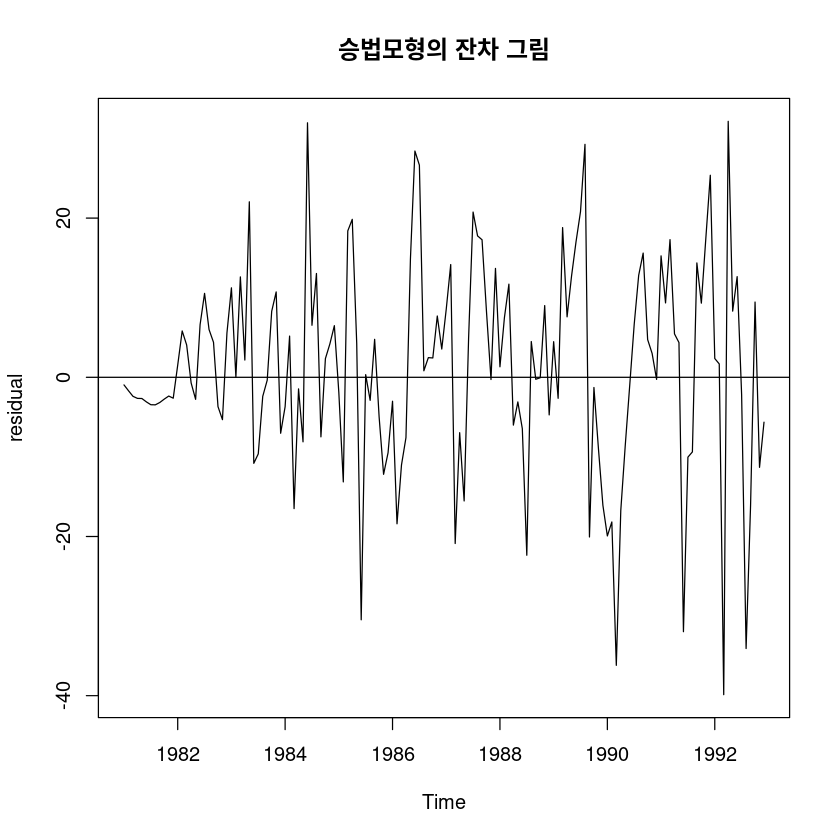

sigma: 0.0465ts.plot(fit7$residual, ylab="residual",

main="승법모형의 잔차 그림"); abline(h=0)

t.test(fit7$residual)

One Sample t-test

data: fit7$residual

t = 1.0873, df = 143, p-value = 0.2787

alternative hypothesis: true mean is not equal to 0

95 percent confidence interval:

-0.9675137 3.3332414

sample estimates:

mean of x

1.182864 dwtest(lm(fit7$residual~1), alternative = 'two.sided')

Durbin-Watson test

data: lm(fit7$residual ~ 1)

DW = 1.4311, p-value = 0.0005873

alternative hypothesis: true autocorrelation is not 0(4)

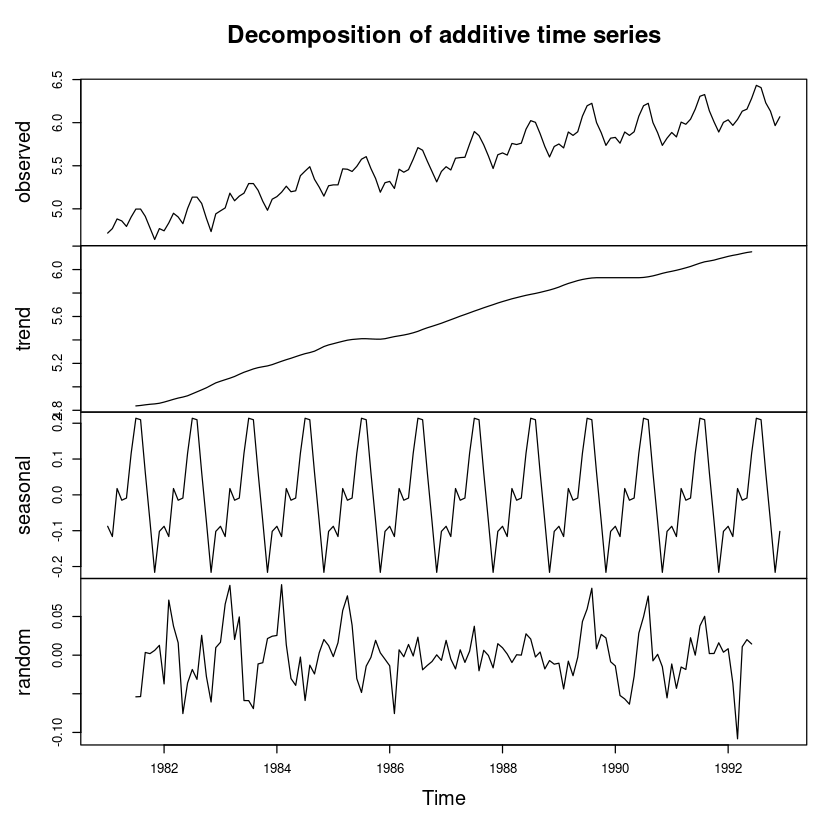

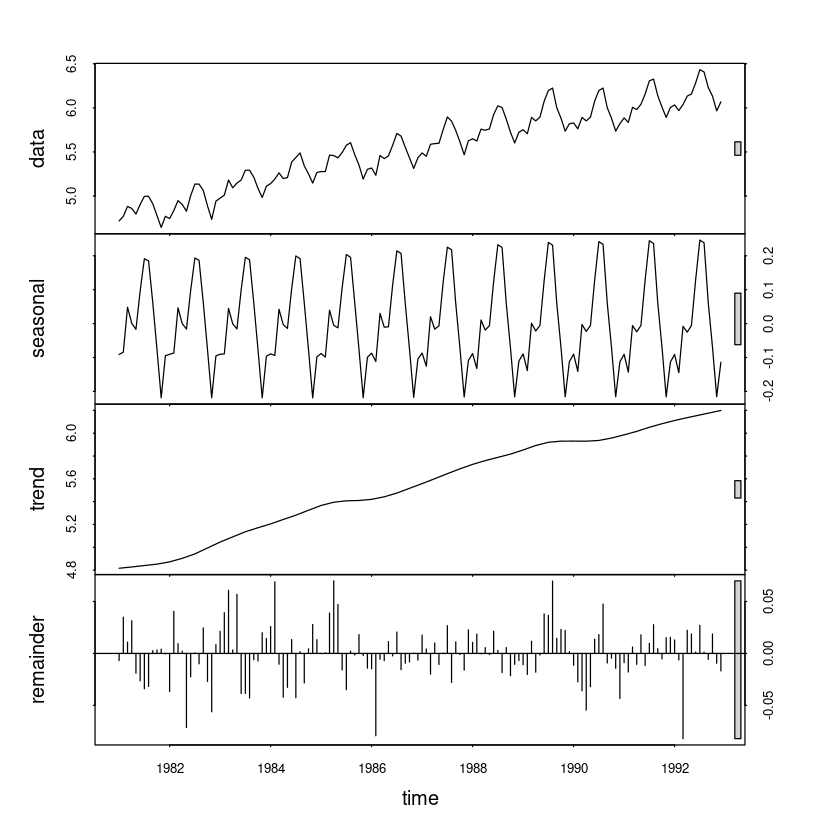

적절한 분해법에 의해 각 성분을 분해해여 시계열 그림을 그려라.

decopose분해법

dec_f_a_l <- decompose(usapass_l, 'additive')plot(dec_f_a_l) # 로그변환 후 분해법

# ## 승법모형 비교용

# dec_f_m <- decompose(usapass, type = "multiplicative")

# plot(dec_f_m)pred_dec_ <- dec_f_a_l$trend + dec_f_a_l$seasonal## 가법모형 vs. 승법모형

pred_dec_ <-dec_f_a_l$trend+dec_f_a_l$seasonal

pred_dec2_ <-dec_f_m$trend*dec_f_m$seasonal

ts.plot(exp(pred_dec_), pred_dec2_, col=1:2, lty=1:2, ylab="usapass", xlab="time")

legend("topleft", lty=1:2, col=1:2, c("가법모형", "승법모형"))

sum((usapass_l-pred_dec_)^2, na.rm=T) stl(비교용)

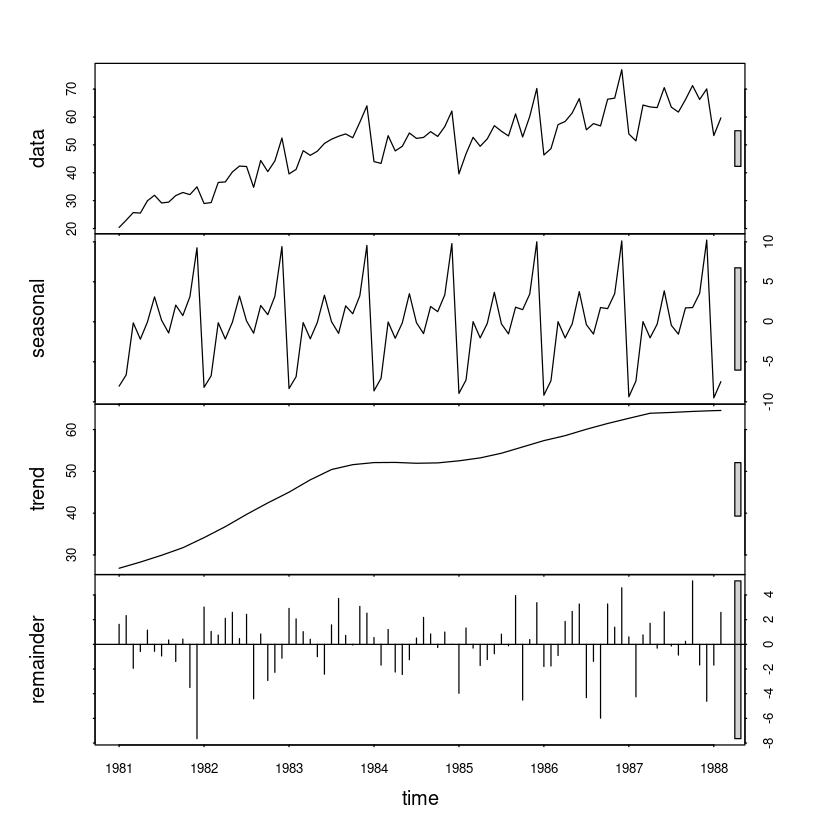

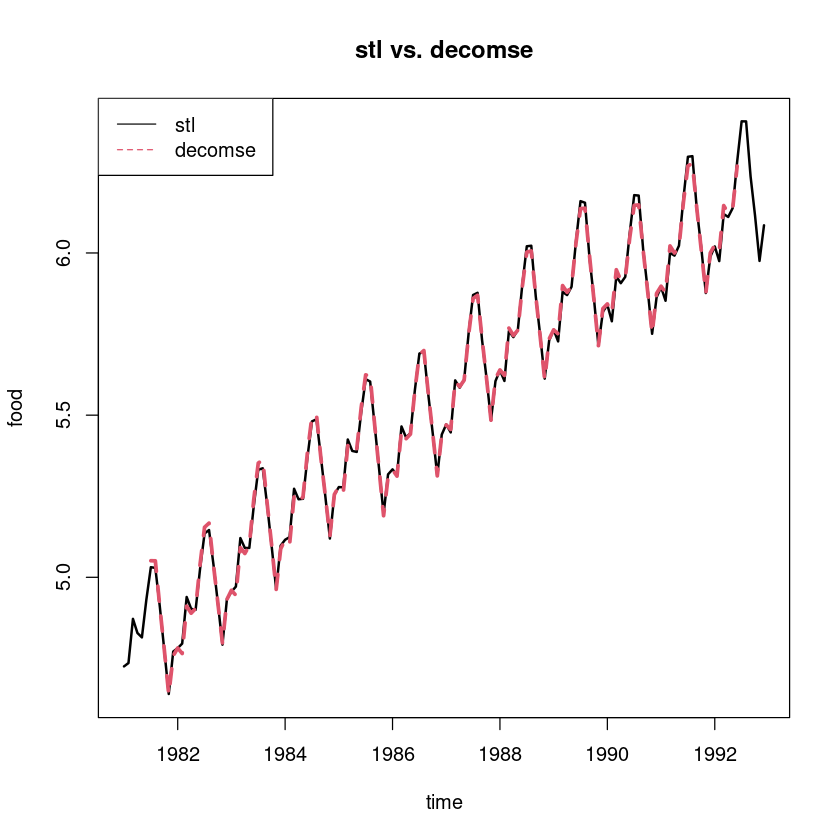

stl_fit11 <- stl(usapass_l, s.window=12)plot(stl_fit11)

## stl vs. decompose

pred_stl <- stl_fit11$time.series[,1]+stl_fit11$time.series[,2]

ts.plot(pred_stl, pred_dec_, col=1:2, lty=1:2, lwd=2:3, ylab="food", xlab="time",

main="stl vs. decomse")

legend("topleft", lty=1:2, col=1:2, c("stl", "decomse"))

### SSE : 1-시차 후 예측 오차 제곱합

sum((usapass_l-pred_stl)^2) #144

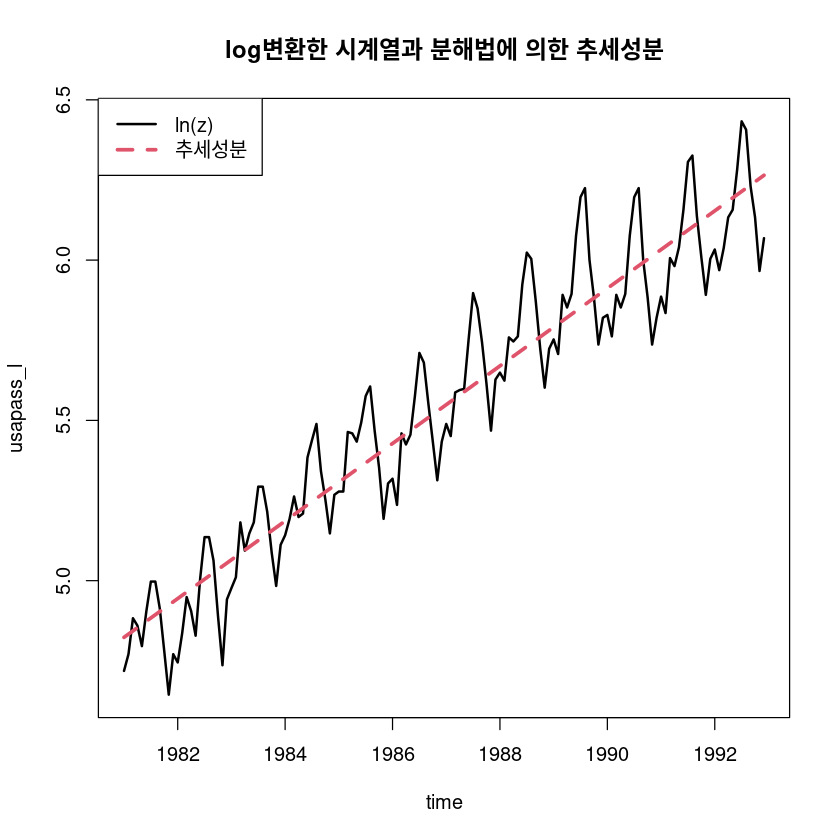

sum((usapass_l-pred_dec_)^2, na.rm=T) #144-12=132추세를 이용한 분해법(가법)

fit45 <- lm(usapass_l ~ t)

summary(fit45)

Call:

lm(formula = usapass_l ~ t)

Residuals:

Min 1Q Median 3Q Max

-0.30875 -0.10481 -0.01736 0.09677 0.36311

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 4.8131072 0.0237011 203.07 <2e-16 ***

t 0.0100802 0.0002836 35.54 <2e-16 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 0.1415 on 142 degrees of freedom

Multiple R-squared: 0.899, Adjusted R-squared: 0.8982

F-statistic: 1263 on 1 and 142 DF, p-value: < 2.2e-16- \(\hat T_t = 4.8131072 + 0.0100802t\)

hat_Tt_l <- fitted(fit45)

ts.plot(usapass_l, hat_Tt_l,

col=1:2,

lty=1:2,

lwd=2:3,

ylab="usapass_l", xlab="time",

main="log변환한 시계열과 분해법에 의한 추세성분")

legend("topleft", lty=1:2, col=1:2, lwd=2:3, c("ln(z)", "추세성분"))

## 원시계열에서 추세성분 조정

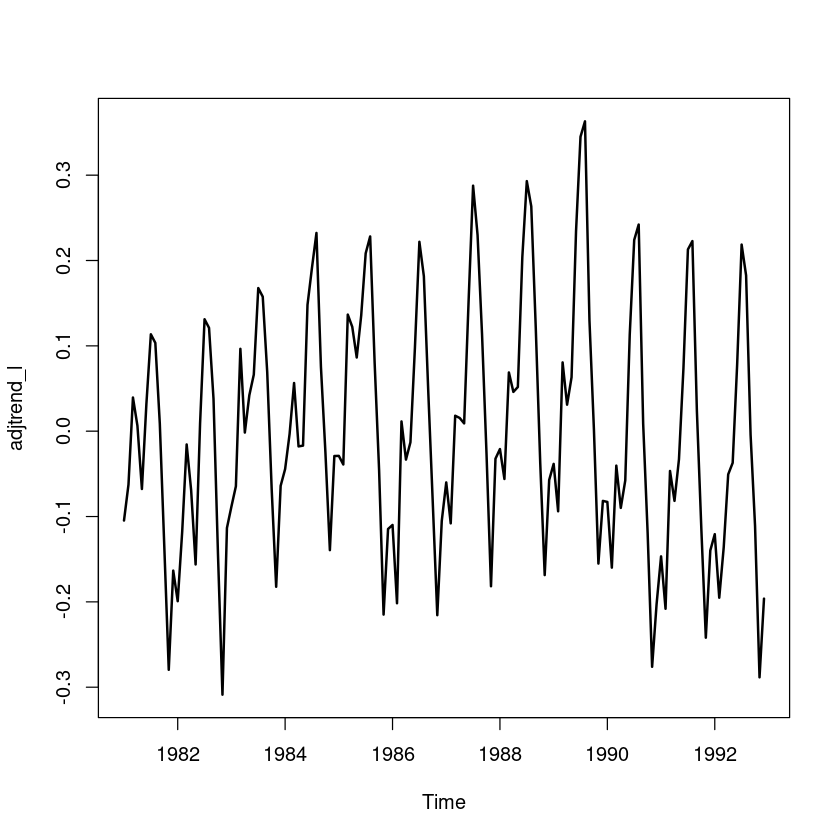

adjtrend_l = usapass_l-hat_Tt_l

plot.ts(adjtrend_l, lwd=2)

## 지시함수를 이용한 계절성분 추정

y = factor(cycle(adjtrend_l)) #범주형 변수로 변환

fit456 <- lm(adjtrend_l ~ 0+y)

summary(fit456)

Call:

lm(formula = adjtrend_l ~ 0 + y)

Residuals:

Min 1Q Median 3Q Max

-0.158515 -0.044012 0.001096 0.045041 0.152437

Coefficients:

Estimate Std. Error t value Pr(>|t|)

y1 -0.08709 0.01790 -4.865 3.20e-06 ***

y2 -0.10916 0.01790 -6.098 1.11e-08 ***

y3 0.02245 0.01790 1.254 0.21195

y4 -0.01022 0.01790 -0.571 0.56899

y5 -0.01075 0.01790 -0.600 0.54926

y6 0.11206 0.01790 6.260 5.00e-09 ***

y7 0.21799 0.01790 12.178 < 2e-16 ***

y8 0.21067 0.01790 11.769 < 2e-16 ***

y9 0.05919 0.01790 3.306 0.00122 **

y10 -0.07583 0.01790 -4.236 4.24e-05 ***

y11 -0.22103 0.01790 -12.348 < 2e-16 ***

y12 -0.10829 0.01790 -6.049 1.40e-08 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 0.06201 on 132 degrees of freedom

Multiple R-squared: 0.8214, Adjusted R-squared: 0.8052

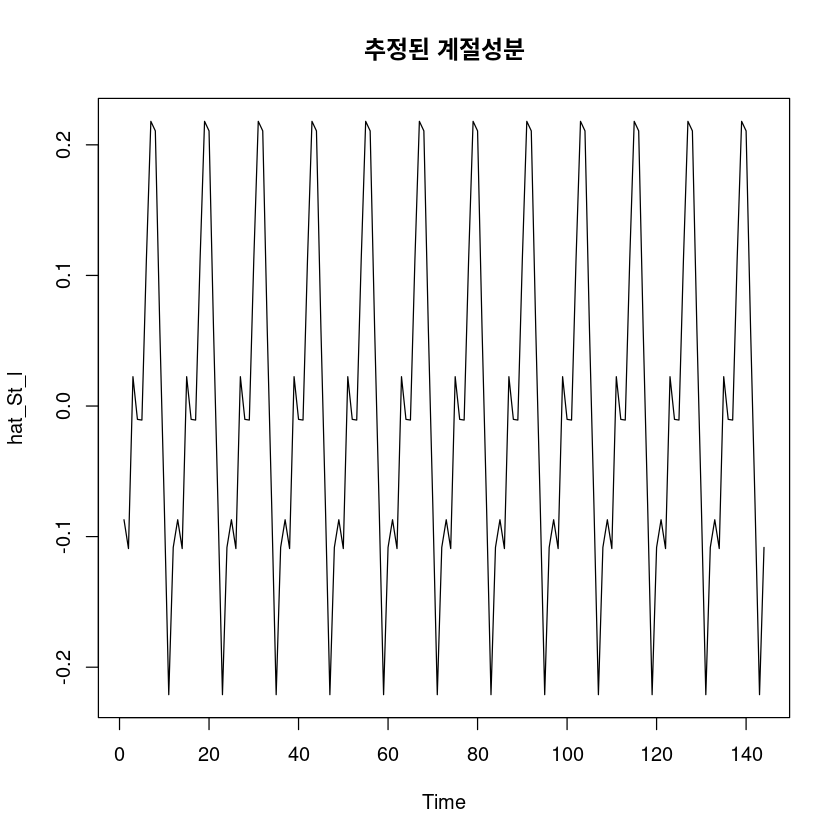

F-statistic: 50.59 on 12 and 132 DF, p-value: < 2.2e-16\(\hat S_t = -0.08709I_1 + \dots - 0.10829I_{12}\)

hat_St_l <- fitted(fit456)

ts.plot(hat_St_l, main="추정된 계절성분")

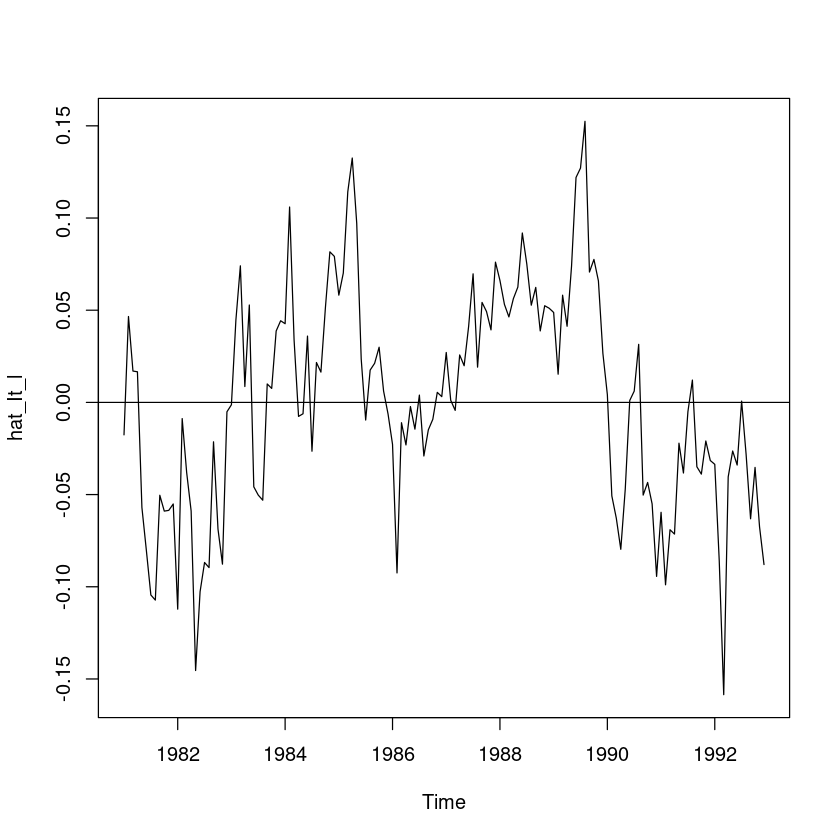

hat_It_l <- usapass_l - hat_Tt_l - hat_St_l

ts.plot(hat_It_l); abline(h=0)

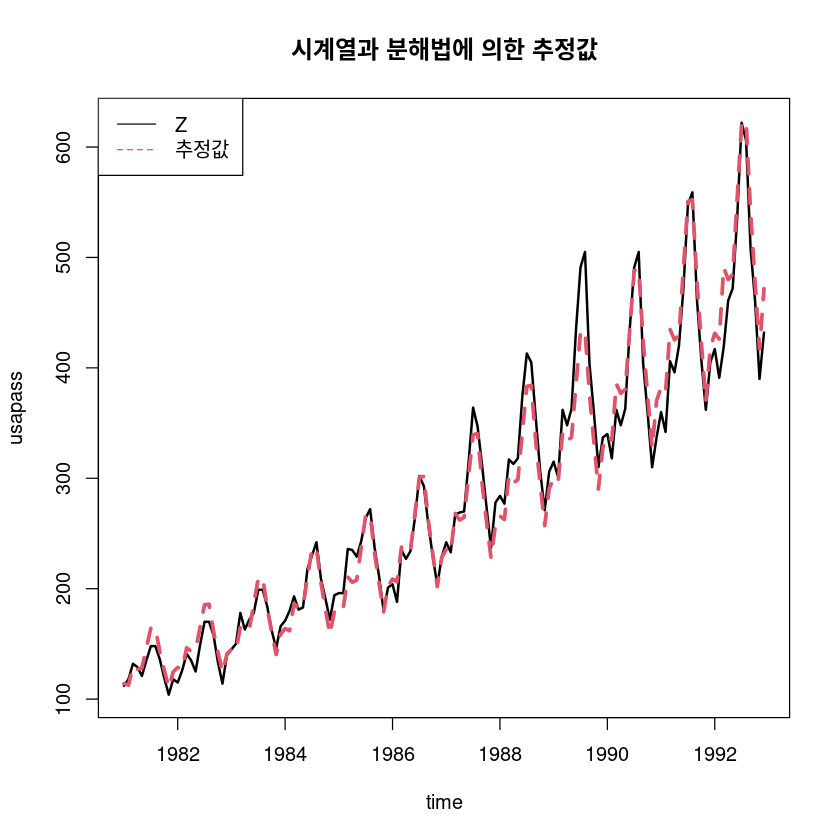

- 추정

pred_a_l <- hat_Tt_l + hat_St_lts.plot(usapass, exp(pred_a_l), col=1:2, lty=1:2, lwd=2:3,ylab="usapass", xlab="time",

main="시계열과 분해법에 의한 추정값")

legend("topleft", lty=1:2, col=1:2, c("Z", "추정값"))

추세를 이용한 분해법(승법)

## 추세성분 추정

fit5 <- lm(usapass ~ t )

summary(fit5)

Call:

lm(formula = usapass ~ t)

Residuals:

Min 1Q Median 3Q Max

-95.238 -31.381 -6.677 24.113 163.347

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 87.41968 7.91971 11.04 <2e-16 ***

t 2.67074 0.09477 28.18 <2e-16 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 47.27 on 142 degrees of freedom

Multiple R-squared: 0.8483, Adjusted R-squared: 0.8473

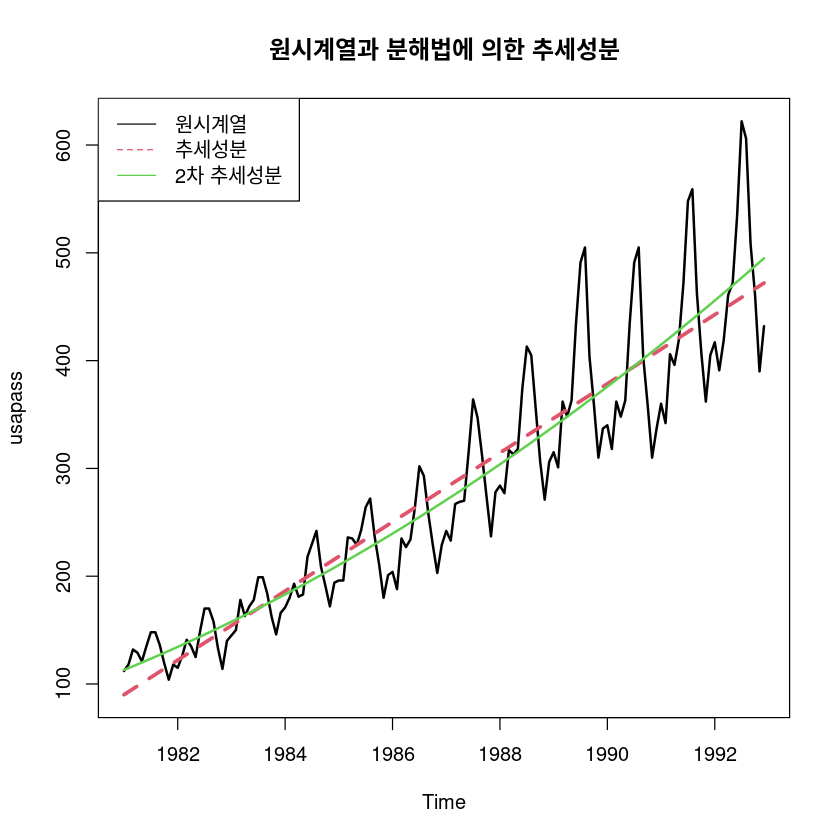

F-statistic: 794.3 on 1 and 142 DF, p-value: < 2.2e-16- \(\hat T_t = 87.41968 + 2.67074t\)

ts.plot(usapass, fitted(fit5) , col=1:2, lty=1:2, lwd=2:3, ylab="usapass", xlab="time",

main="원시계열과 분해법에 의한 추세성분")

legend("topleft", lty=1:2, col=1:2, c("원시계열", "추세성분"))

fit5_ <- lm(usapass ~ t + I(t^2))

summary(fit5_)

Call:

lm(formula = usapass ~ t + I(t^2))

Residuals:

Min 1Q Median 3Q Max

-101.286 -27.201 -7.821 20.791 145.107

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 1.113e+02 1.172e+01 9.494 < 2e-16 ***

t 1.689e+00 3.733e-01 4.525 1.27e-05 ***

I(t^2) 6.770e-03 2.494e-03 2.715 0.00746 **

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 46.25 on 141 degrees of freedom

Multiple R-squared: 0.8559, Adjusted R-squared: 0.8538

F-statistic: 418.6 on 2 and 141 DF, p-value: < 2.2e-16ts.plot(usapass, fitted(fit5), fitted(fit5_), col=1:3, lty=1:2, lwd=2:3, ylab="usapass",

main="원시계열과 분해법에 의한 추세성분")

legend("topleft", lty=1:2, col=1:3, c("원시계열", "추세성분", "2차 추세성분"))

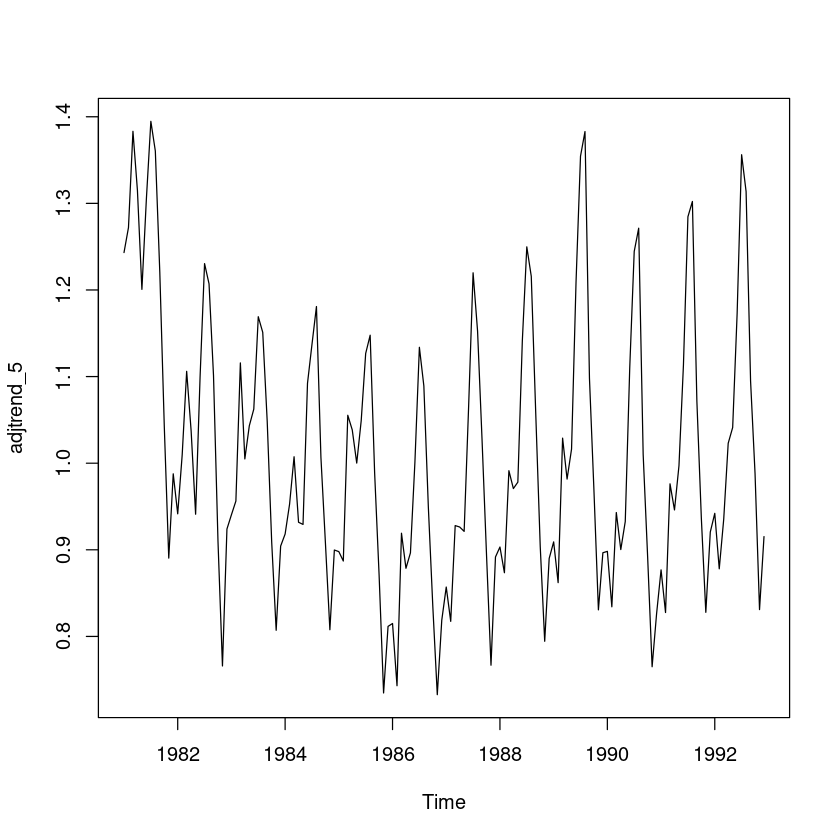

## 원시계열에서 추세성분 조정

trend_5 = fitted(fit5) # 1차 추세모형

adjtrend_5 = usapass/trend_5

plot.ts(adjtrend_5)

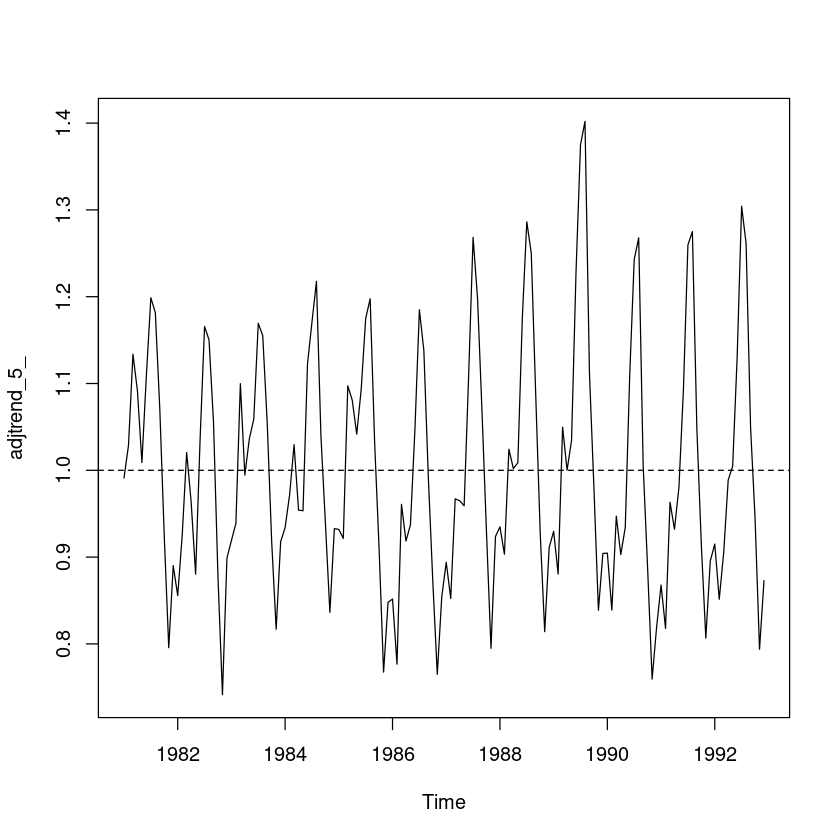

## 원시계열에서 2차 추세성분 조정

trend_5_ = fitted(fit5_) # 2차 추세모형

adjtrend_5_ = usapass/trend_5_

plot.ts(adjtrend_5_)

abline(h=1, lty=2)

## 지시함수를 이용한 계절성분 추정

y = factor(cycle(adjtrend_5_))

fit55 <- lm(adjtrend_5_ ~ 0+y)

summary(fit55)

Call:

lm(formula = adjtrend_5_ ~ 0 + y)

Residuals:

Min 1Q Median 3Q Max

-0.115502 -0.040795 0.001315 0.026514 0.177535

Coefficients:

Estimate Std. Error t value Pr(>|t|)

y1 0.91079 0.01538 59.22 <2e-16 ***

y2 0.89219 0.01538 58.01 <2e-16 ***

y3 1.01655 0.01538 66.10 <2e-16 ***

y4 0.98286 0.01538 63.91 <2e-16 ***

y5 0.98163 0.01538 63.83 <2e-16 ***

y6 1.10939 0.01538 72.13 <2e-16 ***

y7 1.23340 0.01538 80.20 <2e-16 ***

y8 1.22448 0.01538 79.62 <2e-16 ***

y9 1.05099 0.01538 68.34 <2e-16 ***

y10 0.91823 0.01538 59.70 <2e-16 ***

y11 0.79424 0.01538 51.64 <2e-16 ***

y12 0.88904 0.01538 57.81 <2e-16 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 0.05328 on 132 degrees of freedom

Multiple R-squared: 0.9974, Adjusted R-squared: 0.9972

F-statistic: 4301 on 12 and 132 DF, p-value: < 2.2e-16\(\hat S_t = 0.91079I_1 + \dots + 0.88904I_{12}\)

seasonal <- fitted(fit55)

ts.plot(seasonal, main="추정된 계절성분")

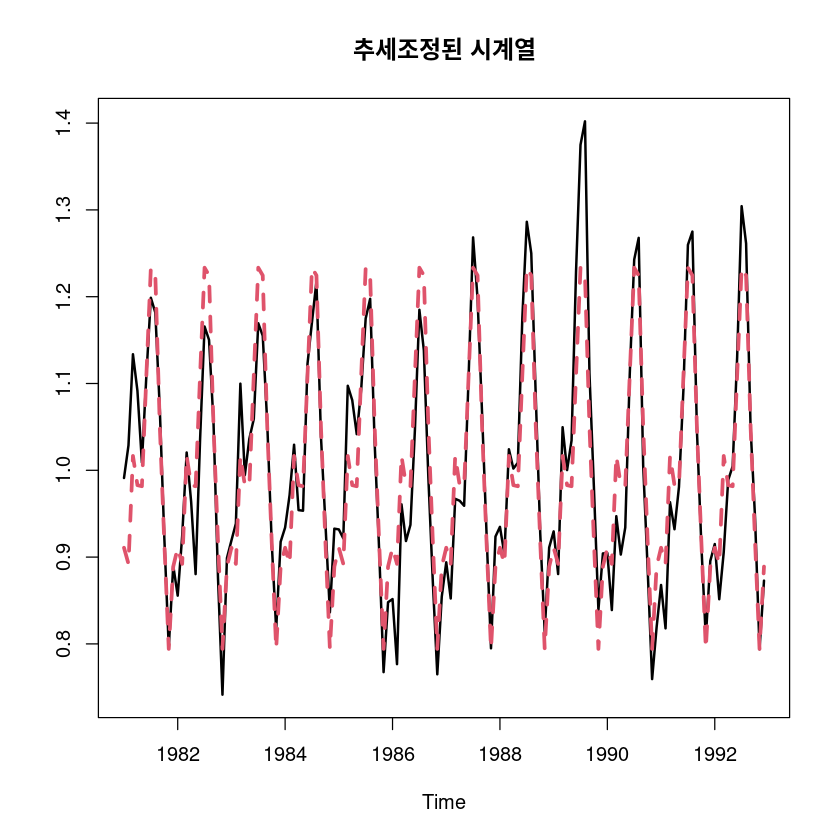

ts.plot(adjtrend_5_, seasonal, col=1:2, lty=1:2, lwd=2:3, main="추세조정된 시계열")

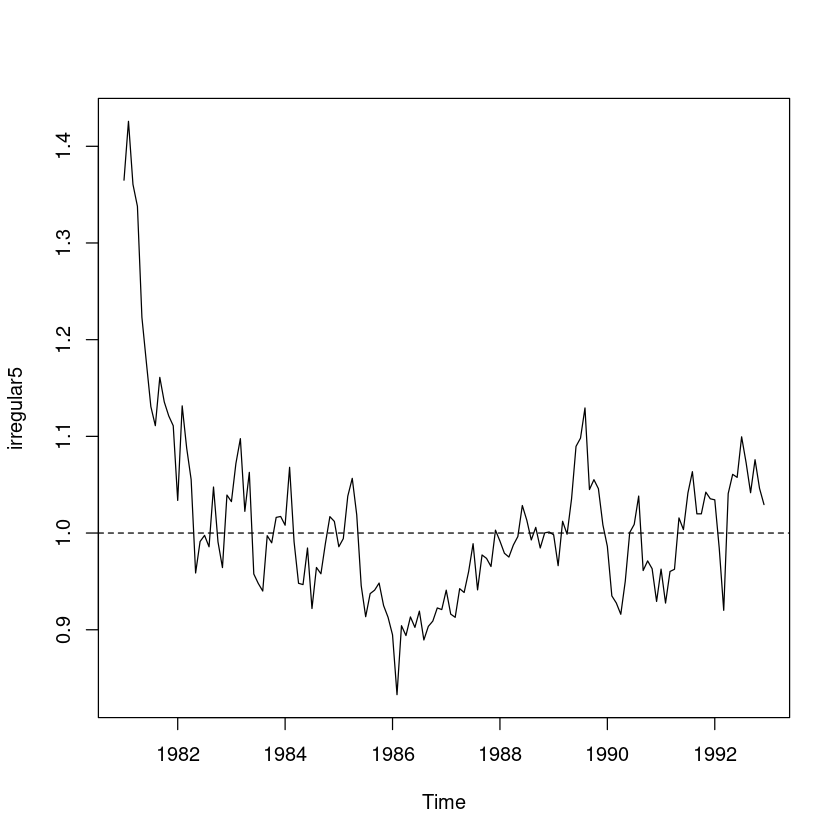

irregular5 <- usapass/trend_5/seasonal

ts.plot(irregular5); abline(h=1, lty=2)

t.test(irregular5, mu=1)

One Sample t-test

data: irregular5

t = 1.2411, df = 143, p-value = 0.2166

alternative hypothesis: true mean is not equal to 1

95 percent confidence interval:

0.994507 1.024030

sample estimates:

mean of x

1.009268 dwtest(lm(irregular5~ 1), alternative = 'two.sided')

Durbin-Watson test

data: lm(irregular5 ~ 1)

DW = 0.19413, p-value < 2.2e-16

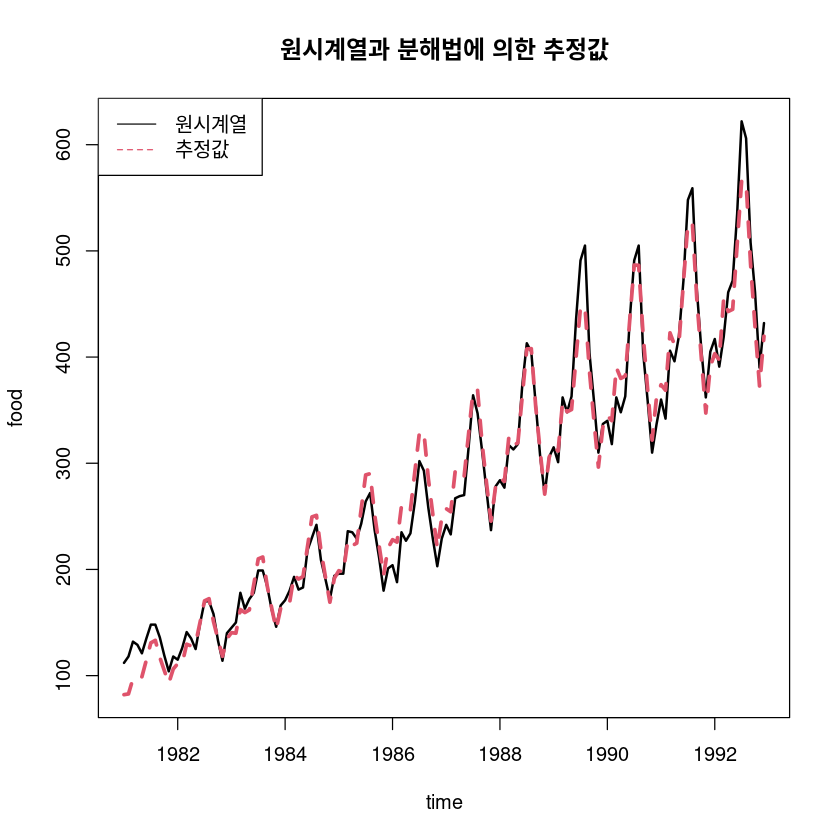

alternative hypothesis: true autocorrelation is not 0pred_m5 <- trend_5 * seasonal

ts.plot(usapass, pred_m5, col=1:2, lty=1:2, lwd=2:3, ylab="food", xlab="time",

main="원시계열과 분해법에 의한 추정값")

legend("topleft", lty=1:2, col=1:2, c("원시계열", "추정값"))

(5) 틀림 ㅠㅠ

각 분석방법에 의한 결과를 1-시착 후 예측오차의 제곱합 (SSE) 기준하에서 비교하여라.

- 추세모형

sum((m3$residuals)^2)- 평활법

exp(fit_hw_l$SSE)- decompose

sum((usapass_l-pred_dec_)^2, na.rm=T) #SSE - 가법- stl

sum((usapass_l-pred_stl)^2,na.rm=T)- 추세를 이용한 분해법(가법)

sum((usapass_l-pred_a_l)^2)